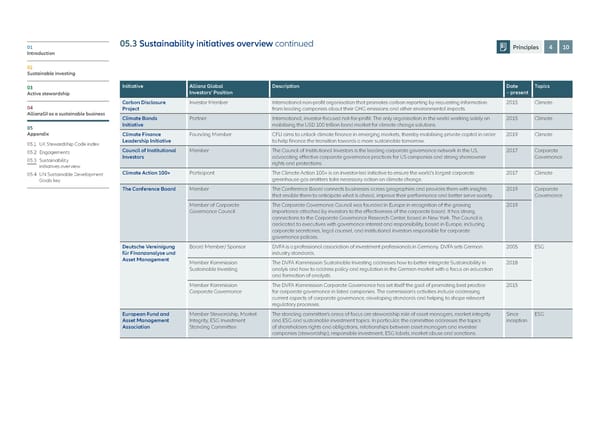

01 05.3 Sustainability initiatives overview continued Principles 4 10 Introduction 02 Sustainable investing 03 Initiative Allianz Global Description Date Topics Active stewardship Investors‘ Position – present Carbon Disclosure Investor Member International non-profit organisation that promotes carbon reporting by requesting information 2015 Climate 04 Project from leading companies about their GHG emissions and other environmental impacts. AllianzGI as a sustainable business Climate Bonds Partner International, investor-focused not-for-profit. The only organisation in the world working solely on 2015 Climate 05 Initiative mobilising the USD 100 trillion bond market for climate change solutions. Appendix Climate Finance Founding Member CFLI aims to unlock climate finance in emerging markets, thereby mobilising private capital in order 2019 Climate 05.1 UK Stewardship Code index Leadership Initiative to help finance the transition towards a more sustainable tomorrow. 05.2 Engagements Council of Institutional Member The Council of Institutional Investors is the leading corporate governance network in the US, 2017 Corporate 05.3 Sustainability Investors advocating effective corporate governance practices for US companies and strong shareowner Governance initiatives overview rights and protections. 05.4 U N Sustainable Development Climate Action 100+ Participant The Climate Action 100+ is an investor-led initiative to ensure the world's largest corporate 2017 Climate Goals key greenhouse gas emitters take necessary action on climate change. The Conference Board Member The Conference Board connects businesses across geographies and provides them with insights 2019 Corporate that enable them to anticipate what is ahead, improve their performance and better serve society. Governance Member of Corporate The Corporate Governance Council was founded in Europe in recognition of the growing 2019 Governance Council importance attached by investors to the effectiveness of the corporate board. It has strong connections to the Corporate Governance Research Center, based in New York. The Council is dedicated to executives with governance interest and responsibility, based in Europe, including corporate secretaries, legal counsel, and institutional investors responsible for corporate governance policies. Deutsche Vereinigung Board Member/ Sponsor DVFA is a professional association of investment professionals in Germany. DVFA sets German 2005 ESG für Finanzanalyse und industry standards. Asset Management Member Kommission The DVFA Kommission Sustainable Investing addresses how to better integrate Sustainability in 2018 Sustainable Investing analyis and how to address policy and regulation in the German market with a focus on education and formation of analysts. Member Kommission The DVFA Kommission Corporate Governance has set itself the goal of promoting best practice 2015 Corporate Governance for corporate governance in listed companies. The commission's activities include addressing current aspects of corporate governance, developing standards and helping to shape relevant regulatory processes. European Fund and Member Stewardship, Market The standing committee’s areas of focus are stewardship role of asset managers, market integrity Since ESG Asset Management Integrity, ESG Investment and ESG and sustainable investment topics. In particular, the committee addresses the topics inception Association Standing Committee of shareholders rights and obligations, relationships between asset managers and investee companies (stewardship), responsible investment, ESG labels, market abuse and sanctions.

Allianz GI Sustainability and Stewardship Report 2021 Page 84 Page 86

Allianz GI Sustainability and Stewardship Report 2021 Page 84 Page 86