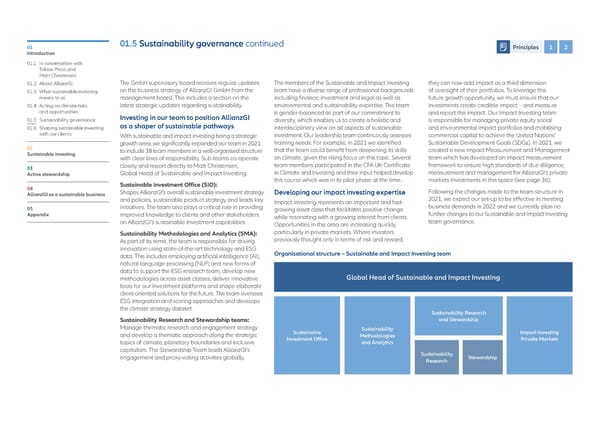

01 01.5 Sustainability governance continued Principles 1 2 Introduction 01.1 In conversation with Tobias Pross and Matt Christensen 01.2 About AllianzGI The GmbH supervisory board receives regular updates The members of the Sustainable and Impact Investing they can now add impact as a third dimension 01.3 What sustainable investing on the business strategy of AllianzGI GmbH from the team have a diverse range of professional backgrounds of oversight of their portfolios. To leverage this means to us management board. This includes a section on the including finance, investment and legal as well as future growth opportunity, we must ensure that our 01.4 Acting on climate risks latest strategic updates regarding sustainability. environmental and sustainability expertise. The team investments create credible impact – and measure and opportunities Investing in our team to position AllianzGI is gender-balanced as part of our commitment to and report this impact. Our Impact Investing team 01.5 Sustainability governance diversity, which enables us to create a holistic and is responsible for managing private equity social 01.6 Shaping sustainable investing as a shaper of sustainable pathways interdisciplinary view on all aspects of sustainable and environmental impact portfolios and mobilising with our clients With sustainable and impact investing being a strategic investment. Our leadership team continuously assesses commercial capital to achieve the United Nations’ growth area, we significantly expanded our team in 2021 training needs. For example, in 2021 we identified Sustainable Development Goals (SDGs). In 2021, we 02 to include 38 team members in a well-organised structure that the team could benefit from deepening its skills created a new Impact Measurement and Management Sustainable investing with clear lines of responsibility. Sub-teams co-operate on climate, given the rising focus on this topic. Several team which has developed an impact measurement 03 closely and report directly to Matt Christensen, team members participated in the CFA UK Certificate framework to ensure high standards of due diligence, Active stewardship Global Head of Sustainable and Impact Investing. in Climate and Investing and their input helped develop measurement and management for AllianzGI’s private Sustainable Investment Office (SIO): this course which was in its pilot phase at the time. markets investments in this space (see page 36). 04 Shapes AllianzGI’s overall sustainable investment strategy Developing our impact investing expertise Following the changes made to the team structure in AllianzGI as a sustainable business 2021, we expect our set-up to be effective in meeting and policies, sustainable product strategy and leads key Impact investing represents an important and fast- 05 initiatives. The team also plays a critical role in providing growing asset class that facilitates positive change business demands in 2022 and we currently plan no Appendix improved knowledge to clients and other stakeholders while resonating with a growing interest from clients. further changes to our Sustainable and Impact Investing on AllianzGI’s sustainable investment capabilities. Opportunities in this area are increasing quickly, team governance. Sustainability Methodologies and Analytics (SMA): particularly in private markets. Where investors As part of its remit, the team is responsible for driving previously thought only in terms of risk and reward, innovation using state-of-the-art technology and ESG Organisational structure – Sustainable and Impact Investing team data. This includes employing artificial intelligence (AI), natural language processing (NLP) and new forms of data to support the ESG research team, develop new methodologies across asset classes, deliver innovative Global Head of Sustainable and Impact Investing tools for our investment platforms and shape elaborate client-oriented solutions for the future. The team oversees ESG integration and scoring approaches and develops the climate strategy dataset. Sustainability Research Sustainability Research and Stewardship teams: and Stewardship Manage thematic research and engagement strategy Sustainable Sustainability Impact Investing and develop a thematic approach along the strategic Investment Office Methodologies Private Markets topics of climate, planetary boundaries and inclusive and Analytics capitalism. The Stewardship Team leads AllianzGI’s Sustainability engagement and proxy-voting activities globally. Research Stewardship

Allianz GI Sustainability and Stewardship Report 2021 Page 15 Page 17

Allianz GI Sustainability and Stewardship Report 2021 Page 15 Page 17