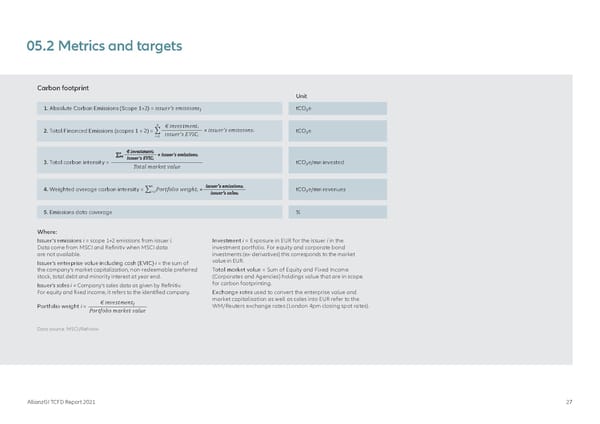

05.2 Metrics and targets Carbon footprint Unit 1. Absolute Carbon Emissions (Scope 1+2) =issuer's emissions tCO₂e i n € investmenti × issuer's emissions 2. Total Financed Emissions (scopes 1 + 2) = ∑ issuer's EVIC i tCO₂e i=1 i 3. Total carbon intensity = Total market value tCO₂e/mn invested n 4. Weighted average carbon intensity = ∑ Portfolio weighti × tCO₂e/mn revenues i=1 5. Emissions data coverage % Where: Issuer’s emissions i = scope 1+2 emissions from issuer i. Investment i = Exposure in EUR for the issuer i in the Data come from MSCI and Refinitiv when MSCI data investment portfolio. For equity and corporate bond are not available. investments (ex-derivatives) this corresponds to the market Issuer’s enterprise value including cash (EVIC) i = the sum of value in EUR. the company’s market capitalization, non-redeemable preferred Total market value = Sum of Equity and Fixed Income stock, total debt and minority interest at year end. (Corporates and Agencies) holdings value that are in scope Issuer’s sales i = Company’s sales data as given by Refinitiv. for carbon footprinting. For equity and fixed income, it refers to the identified company. Exchange rates used to convert the enterprise value and € investmenti market capitalisation as well as sales into EUR refer to the Portfolio weight i = WM/Reuters exchange rates (London 4pm closing spot rates). Portfolio market value Data source: MSCI/Refinitiv AllianzGI TCFD Report 2021 27

TCFD Report Page 26 Page 28

TCFD Report Page 26 Page 28