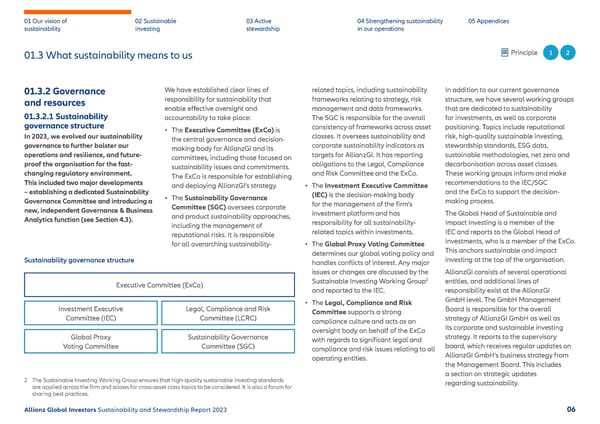

01 Our vision of 02 Sustainable 03 Active 04 Strengthening sustainability 05 Appendices sustainability investing stewardship in our operations Principle 1 2 01.3 What sustainability means to us 01.3.2 Governance We have established clear lines of related topics, including sustainability In addition to our current governance and resources responsibility for sustainability that frameworks relating to strategy, risk structure, we have several working groups enable e昀昀ective oversight and management and data frameworks. that are dedicated to sustainability 01.3.2.1 Sustainability accountability to take place: The SGC is responsible for the overall for investments, as well as corporate governance structure • The Executive Committee (ExCo) is consistency of frameworks across asset positioning. Topics include reputational In 2023, we evolved our sustainability the central governance and decision- classes. It oversees sustainability and risk, high-quality sustainable investing, governance to further bolster our making body for AllianzGI and its corporate sustainability indicators as stewardship standards, ESG data, operations and resilience, and future- committees, including those focused on targets for AllianzGI. It has reporting sustainable methodologies, net zero and proof the organisation for the fast- sustainability issues and commitments. obligations to the Legal, Compliance decarbonisation across asset classes. changing regulatory environment. The ExCo is responsible for establishing and Risk Committee and the ExCo. These working groups inform and make This included two major developments and deploying AllianzGI’s strategy. • The Investment Executive Committee recommendations to the IEC/SGC –establishing a dedicated Sustainability • The Sustainability Governance (IEC) is the decision-making body and the ExCo to support the decision- Governance Committee and introducing a Committee (SGC) oversees corporate for the management of the firm’s making process. new, independent Governance & Business and product sustainability approaches, investment platform and has The Global Head of Sustainable and Analytics function (see Section 4.3). including the management of responsibility for all sustainability- Impact Investing is a member of the reputational risks. It is responsible related topics within investments. IEC and reports to the Global Head of for all overarching sustainability- • The Global Proxy Voting Committee Investments, who is a member of the ExCo. determines our global voting policy and This anchors sustainable and impact Sustainability governance structure handles conflicts of interest. Any major investing at the top of the organisation. issues or changes are discussed by the AllianzGI consists of several operational 2 entities, and additional lines of Executive Committee (ExCo) Sustainable Investing Working Group and reported to the IEC. responsibility exist at the AllianzGI • The Legal, Compliance and Risk GmbH level. The GmbH Management Investment Executive Legal, Compliance and Risk Committee supports a strong Board is responsible for the overall Committee (IEC) Committee (LCRC) compliance culture and acts as an strategy of AllianzGI GmbH as well as oversight body on behalf of the ExCo its corporate and sustainable investing Global Proxy Sustainability Governance with regards to significant legal and strategy. It reports to the supervisory Voting Committee Committee (SGC) compliance and risk issues relating to all board, which receives regular updates on operating entities. AllianzGI GmbH’s business strategy from the Management Board. This includes a section on strategic updates 2 The Sustainable Investing Working Group ensures that high-quality sustainable investing standards regarding sustainability. are applied across the 昀椀rm and allows for cross-asset class topics to be considered. It is also a forum for sharing best practices. Allianz Global Investors Sustainability and Stewardship Report 2023 06

2023 | Sustainability Report Page 6 Page 8

2023 | Sustainability Report Page 6 Page 8