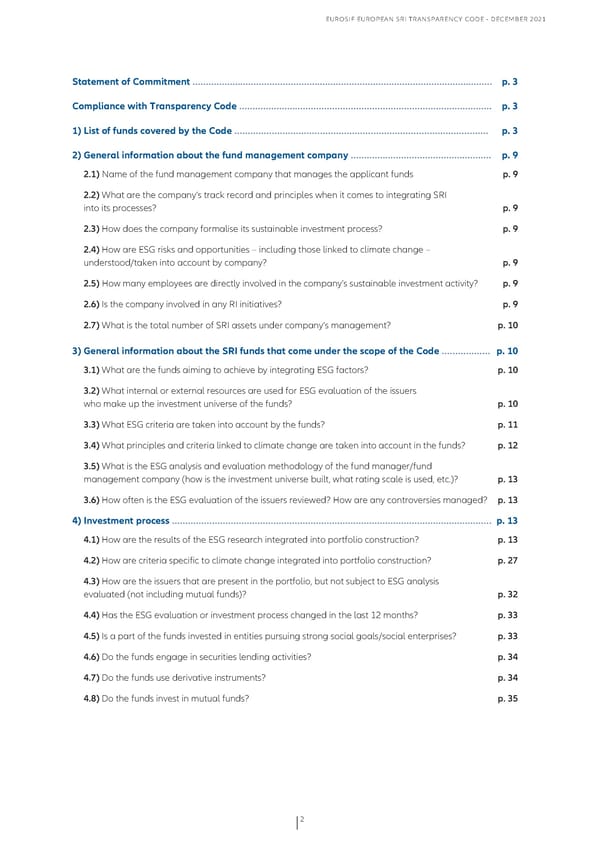

EuRoSIf EuRopEaN SRI TRaNSpaRENcy coDE - DEcEmbER 2021 Statement of Commitment ................................................................................................................. p. 3 Compliance with Transparency Code ............................................................................................... p. 3 1) List of funds covered by the Code ............................................................................................... p. 3 2) General information about the fund management company ..................................................... p. 9 2.1) Name of the fund management company that manages the applicant funds p. 9 2.2) What are the company’s track record and principles when it comes to integrating SRI into its processes? p. 9 2.3) How does the company formalise its sustainable investment process? p. 9 2.4) How are ESG risks and opportunities – including those linked to climate change – understood/taken into account by company? p. 9 2.5) How many employees are directly involved in the company’s sustainable investment activity? p. 9 2.6) Is the company involved in any RI initiatives? p. 9 2.7) What is the total number of SRI assets under company’s management? p. 10 3) General information about the SRI funds that come under the scope of the Code .................. p. 10 3.1) What are the funds aiming to achieve by integrating ESG factors? p. 10 3.2) What internal or external resources are used for ESG evaluation of the issuers who make up the investment universe of the funds? p. 10 3.3) What ESG criteria are taken into account by the funds? p. 11 3.4) What principles and criteria linked to climate change are taken into account in the funds? p. 12 3.5) What is the ESG analysis and evaluation methodology of the fund manager/fund management company (how is the investment universe built, what rating scale is used, etc.)? p. 13 3.6) How often is the ESG evaluation of the issuers reviewed? How are any controversies managed? p. 13 4) Investment process ........................................................................................................................ p. 13 4.1) How are the results of the ESG research integrated into portfolio construction? p. 13 4.2) How are criteria specific to climate change integrated into portfolio construction? p. 27 4.3) How are the issuers that are present in the portfolio, but not subject to ESG analysis evaluated (not including mutual funds)? p. 32 4.4) Has the ESG evaluation or investment process changed in the last 12 months? p. 33 4.5) Is a part of the funds invested in entities pursuing strong social goals/social enterprises? p. 33 4.6) Do the funds engage in securities lending activities? p. 34 4.7) Do the funds use derivative instruments? p. 34 4.8) Do the funds invest in mutual funds? p. 35 2

Eurosif European SRI Transparency Code Page 1 Page 3

Eurosif European SRI Transparency Code Page 1 Page 3