Executive summary - Sustainability and Stewardship Report 2021

2021 | 11 pages

Shaping pathways to a sustainable future Allianz Global Investors Executive summary of our Sustainability and Stewardship Report 2021

Welcome 02 Welcome Shaping pathways to a sustainable future 03 What sustainable investing means to us 04 Acting on climate risks and opportunities 05 Sustainable investing 06 Active stewardship 08 Collaborative engagement 09 Influencing companies through proxy voting 10 AllianzGI as a sustainable business 11 Welcome to the executive summary of our Sustainability and Stewardship Report 2021 Allianz Global Investors (AllianzGI) is Sustainability is an area filled with innovative and This reporting relates to all AllianzGI activities and an active investment management firm progressive approaches. We shape sustainable locations for the 2021 fiscal year (1 January 2021 to and part of Allianz Group. Sustainable pathways for our clients by offering a range of 31 December 2021) unless otherwise stated. investment options and guidance in public and, Read our Sustainability and Stewardship investing is a core part of our strategy increasingly, in private markets. Report 2021. to shape pathways that secure the Our sustainability reporting incorporates our Find out more about our sustainability capabilities. future for our clients, our business commitment to environment, social and governance and society as a whole. (ESG) and active stewardship across all our activities and investments. This executive summary report includes highlights from our full Sustainability and Stewardship Report 2021: Shaping pathways to a sustainable future.

Welcome 02 Shaping pathways to a sustainable future Shaping pathways to a Introduction from Tobias Pross and Matt Christensen sustainable future 03 What sustainable investing means to us 04 Tobias Pross Matt Christensen 2021 highlights Acting on climate risks Chief Executive Officer, Global Head of Sustainable and opportunities 05 Allianz Global Investors and Impact Investing, Allianz Global Investors Sustainable investing 06 Total AllianzGI assets under management (AuM) Active stewardship 08 EUR 673 billion Collaborative engagement 09 “ Sustainability is a fast- “ We have reached a tipping evolving space and it is point where investors Total value of ESG and Influencing companies sustainable investment offering through proxy voting 10 1 vital we keep pace with our now expect sustainability EUR 303 billion AllianzGI as a clients’ thinking and major to inform investment sustainable business 11 +47% advances in understanding decisions. This thinking has increase in AuM in sustainable around both the challenges guided the build-out of our investments compared to 2020 and opportunities. We sustainability team and 5 A+ ratings and 3 A ratings are committed to making capabilities at AllianzGI within the United Nations Principles for progress in pursuit of the over the past year. The Responsible Investment (PRI) assessment2 goals that our clients – and opportunity to create more Joined society – seek. That is the sustainable infrastructure Net Zero Asset Managers initiative and purpose of our transparent and – crucially – to foster One Planet Asset Managers initiative and balanced reporting.” equitable growth must be Controversial weapons and Read the full conversation seized wholeheartedly.” thermal coal exclusion policy with Tobias Pross and Matt Christensen on page 03 adopted firmwide for all mutual funds in our 2021 Sustainability that we manage and Stewardship Report. Active stewardship: 299 engagements covering 1 This figure includes EUR 156 billion of integrated ESG assets that are not considered sustainable according to EU Sustainable Finance Disclosure Regulation. 482 topics 2 Reporting period January 2019 – December 2019. PRI reporting has been delayed by the PRI Association by one year. Ratings for the reporting period January 2020 – December 2020 are expected to be available by June 2022, while ratings for the reporting period January 2021 – December 2021 will not be available at all.

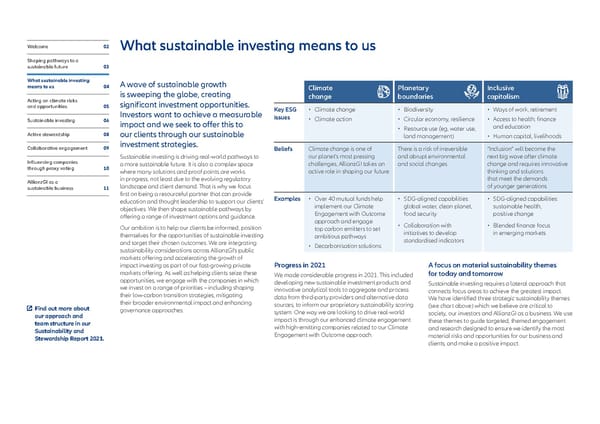

Welcome 02 What sustainable investing means to us Shaping pathways to a sustainable future 03 What sustainable investing A wave of sustainable growth means to us 04 Climate Planetary Inclusive is sweeping the globe, creating change boundaries capitalism Acting on climate risks significant investment opportunities. and opportunities 05 Key ESG • Climate change • Biodiversity • Ways of work, retirement Investors want to achieve a measurable issues • Climate action • Circular economy, resilience • Access to health, finance Sustainable investing 06 impact and we seek to offer this to • Resource use (eg, water use, and education Active stewardship 08 our clients through our sustainable land management) • Human capital, livelihoods Collaborative engagement 09 investment strategies. Beliefs Climate change is one of There is a risk of irreversible “Inclusion” will become the Sustainable investing is driving real-world pathways to our planet’s most pressing and abrupt environmental next big wave after climate Influencing companies a more sustainable future. It is also a complex space challenges, AllianzGI takes an and social changes change and requires innovative through proxy voting 10 where many solutions and proof points are works active role in shaping our future thinking and solutions AllianzGI as a in progress, not least due to the evolving regulatory that meet the demands sustainable business 11 landscape and client demand. That is why we focus of younger generations first on being a resourceful partner that can provide Examples • Over 40 mutual funds help • SDG-aligned capabilities: • SDG-aligned capabilities: education and thought leadership to support our clients’ implement our Climate global water, clean planet, sustainable health, objectives. We then shape sustainable pathways by Engagement with Outcome food security positive change offering a range of investment options and guidance. approach and engage Our ambition is to help our clients be informed, position top carbon emitters to set • Collaboration with • Blended finance focus themselves for the opportunities of sustainable investing ambitious pathways initiatives to develop in emerging markets and target their chosen outcomes. We are integrating standardised indicators sustainability considerations across AllianzGI’s public • Decarbonisation solutions markets offering and accelerating the growth of impact investing as part of our fast-growing private Progress in 2021 A focus on material sustainability themes markets offering. As well as helping clients seize these We made considerable progress in 2021. This included for today and tomorrow opportunities, we engage with the companies in which developing new sustainable investment products and Sustainable investing requires a lateral approach that we invest on a range of priorities – including shaping innovative analytical tools to aggregate and process connects focus areas to achieve the greatest impact. their low-carbon transition strategies, mitigating data from third-party providers and alternative data We have identified three strategic sustainability themes their broader environmental impact and enhancing sources, to inform our proprietary sustainability scoring (see chart above) which we believe are critical to Find out more about governance approaches. system. One way we are looking to drive real-world society, our investors and AllianzGI as a business. We use our approach and impact is through our enhanced climate engagement these themes to guide targeted, themed engagement team structure in our with high-emitting companies related to our Climate and research designed to ensure we identify the most Sustainability and Engagement with Outcome approach. material risks and opportunities for our business and Stewardship Report 2021. clients, and make a positive impact.

Welcome 02 Acting on climate risks and opportunities Shaping pathways to a sustainable future 03 What sustainable investing As an active investor, we look for After becoming a NZAM signatory in 2021, means to us 04 we submitted interim targets at the beginning of innovative ways to reallocate capital to 2022. As the first step, these targets cover listed equity, Shaping pathways for a sustainable future Acting on climate risks support a climate transition that meets and opportunities 05 corporate debt, infrastructure equity, and infrastructure Funding the world’s the goals of the Paris Agreement. We debt, and reflect the targets set in 2021 by Allianz Sustainable investing 06 joined the Net Zero Asset Managers for its proprietary assets based on its commitment largest offshore as a member of the UN-convened Net-Zero Asset windfarm Active stewardship 08 initiative in 2021 and published our Owner Alliance. Collaborative engagement 09 annual Task Force on Climate-Related The assets in-scope for these targets represent 12% Financial Disclosures (TCFD) Report. of AllianzGI’s overall assets under management. In December 2021, Allianz Capital Influencing companies According to the World Economic Forum’s Global Risks The submitted targets include: Partners (ACP) announced its agreement through proxy voting 10 Report 2022, failure to mitigate or adapt to climate Listed equity and corporate bonds – 25% GHG to purchase a 25.2% stake in the AllianzGI as a change comes first in the top 10 global risks over the reduction, Scopes 1 and 2, by the end of 2024 Hollandse Kust Zuid (HKZ) windfarm sustainable business 11 next decade. In this context, we help our clients reflect (baseline year: 2019). in the North Sea. climate risks and opportunities in their holdings to Infrastructure equity – 28% GHG reduction, Scopes 1 shape pathways towards net zero. Next to mainstream and 2, by the end of 2025 (baseline year: 2020). Once fully operational in 2023, it will be the largest strategies, we offer climate thematic and impact-driven offshore windfarm in the world with 140 wind opportunities such as green bonds, climate transition Infrastructure debt – Our target is to grow the share turbines and a total installed capacity of 1.5GW. equity and illiquid renewable energy equity. These of low-emitting and EU taxonomy-eligible assets. specialised assets contribute to the alignment of an At AllianzGI, we will focus continuously on our net- asset owner’s portfolio and its compatibility with climate zero commitment as a signatory of NZAM. In the transition targets. near future, we will increase the scope of our assets Our sustainable investment team, portfolio managers and set intermediate targets for our third-party client and analysts monitor and assess the science, regulatory assets. We will continue to actively engage with our response and business implications of climate change. institutional clients and distributors on integrating We engage with companies on climate-related issues net-zero objectives in their investments and into our and encourage them to report on TCFD and Science mutual funds. We plan to review our targets and Based Targets to improve the quality of disclosures progress annually. For more information provided to our investors, positioning them to meet their Increasing transparency on climate-related risk climate ambitions more precisely. management process, Membership of the Net Zero Asset Transition and physical climate factors may pose please read our separate Managers initiative a significant risk or opportunity through the assets TCFD Report 2021. we manage on behalf of our clients, the investment We aim to be as transparent as possible in our products at the core of our business, and how we climate-related profile, including the disclosure of our operate as a business. We support and implement investment-related climate metrics. As a committed the recommendations of the TCFD. signatory of the Net Zero Asset Managers initiative (NZAM), we support the goal of net-zero greenhouse gas (GHG) emissions by 2050 – in line with global efforts to limit warming to 1.5°C.

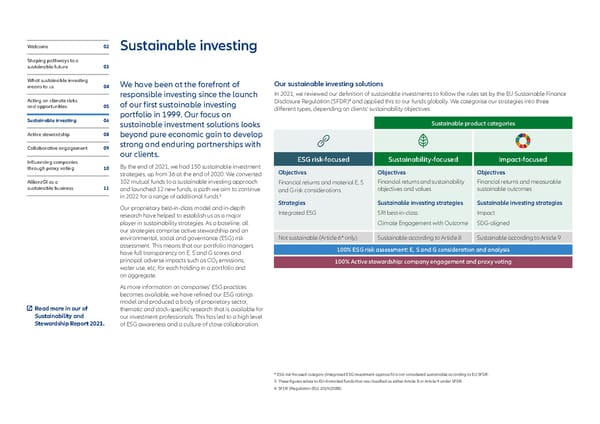

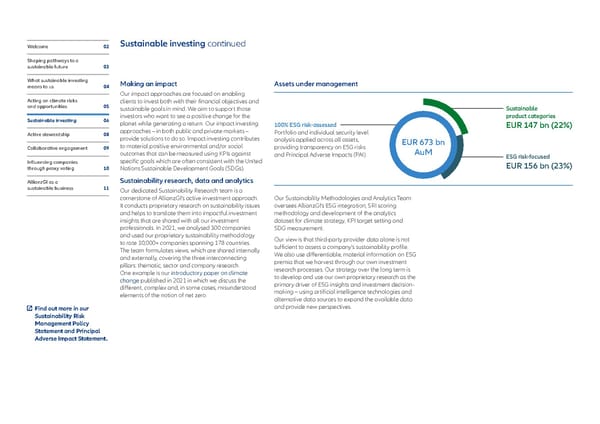

Welcome 02 Sustainable investing Shaping pathways to a sustainable future 03 What sustainable investing We have been at the forefront of Our sustainable investing solutions means to us 04 responsible investing since the launch In 2021, we reviewed our definition of sustainable investments to follow the rules set by the EU Sustainable Finance Acting on climate risks 4 of our first sustainable investing Disclosure Regulation (SFDR) and applied this to our funds globally. We categorise our strategies into three and opportunities 05 different types, depending on clients’ sustainability objectives: portfolio in 1999. Our focus on Sustainable investing 06 sustainable investment solutions looks Sustainable product categories Active stewardship 08 beyond pure economic gain to develop Collaborative engagement 09 strong and enduring partnerships with our clients. ESG risk-focused Sustainability-focused Impact-focused Influencing companies By the end of 2021, we had 150 sustainable investment through proxy voting 10 Objectives Objectives Objectives strategies, up from 36 at the end of 2020. We converted AllianzGI as a 102 mutual funds to a sustainable investing approach Financial returns and material E, S Financial returns and sustainability Financial returns and measurable sustainable business 11 and launched 12 new funds, a path we aim to continue and G risk considerations objectives and values sustainable outcomes in 2022 for a range of additional funds.3 Our proprietary best-in-class model and in-depth Strategies Sustainable investing strategies Sustainable investing strategies research have helped to establish us as a major Integrated ESG SRI best-in-class Impact player in sustainability strategies. As a baseline, all Climate Engagement with Outcome SDG-aligned our strategies comprise active stewardship and an environmental, social and governance (ESG) risk Not sustainable (Article 6* only) Sustainable according to Article 8 Sustainable according to Article 9 assessment. This means that our portfolio managers 100% ESG risk assessment: E, S and G consideration and analysis have full transparency on E, S and G scores and principal adverse impacts such as CO emissions, 2 100% Active stewardship: company engagement and proxy voting water use, etc, for each holding in a portfolio and on aggregate. As more information on companies’ ESG practices becomes available, we have refined our ESG ratings model and produced a body of proprietary sector, Read more in our of thematic and stock-specific research that is available for Sustainability and our investment professionals. This has led to a high level Stewardship Report 2021. of ESG awareness and a culture of close collaboration. * ESG risk-focused category (Integrated ESG investment approach) is not considered sustainable according to EU SFDR. 3 These figures relate to EU-domiciled funds that are classified as either Article 8 or Article 9 under SFDR. 4 SFDR (Regulation (EU) 2019/2088).

Welcome 02 Sustainable investing continued Shaping pathways to a sustainable future 03 What sustainable investing Making an impact Assets under management means to us 04 Our impact approaches are focused on enabling Acting on climate risks clients to invest both with their financial objectives and and opportunities 05 sustainable goals in mind. We aim to support those Sustainable Sustainable investing 06 investors who want to see a positive change for the product categories planet while generating a return. Our impact investing 1% ES risassessed EUR 147 bn (22%) Active stewardship 08 approaches – in both public and private markets – Portfolio and individual security level provide solutions to do so. Impact investing contributes analysis applied across all assets, EUR 673 bn Collaborative engagement 09 to material positive environmental and/or social providing transparency on ESG risks AuM outcomes that can be measured using KPIs against and Principal Adverse Impacts (PAI) ES risocused Influencing companies specific goals which are often consistent with the United EUR 16 bn (23%) through proxy voting 10 Nations Sustainable Development Goals (SDGs). AllianzGI as a Sustainability research, data and analytics sustainable business 11 Our dedicated Sustainability Research team is a cornerstone of AllianzGI’s active investment approach. Our Sustainability Methodologies and Analytics Team It conducts proprietary research on sustainability issues oversees AllianzGI’s ESG integration, SRI scoring and helps to translate them into impactful investment methodology and development of the analytics insights that are shared with all our investment dataset for climate strategy, KPI target setting and professionals. In 2021, we analysed 300 companies SDG measurement. and used our proprietary sustainability methodology Our view is that third-party provider data alone is not to rate 10,000+ companies spanning 178 countries. sufficient to assess a company’s sustainability profile. The team formulates views, which are shared internally We also use differentiable, material information on ESG and externally, covering the three interconnecting premia that we harvest through our own investment pillars: thematic, sector and company research. research processes. Our strategy over the long term is One example is our introductory paper on climate to develop and use our own proprietary research as the change published in 2021 in which we discuss the primary driver of ESG insights and investment decision- different, complex and, in some cases, misunderstood making – using artificial intelligence technologies and elements of the notion of net zero. alternative data sources to expand the available data Find out more in our and provide new perspectives. Sustainability Risk Management Policy Statement and Principal Adverse Impact Statement.

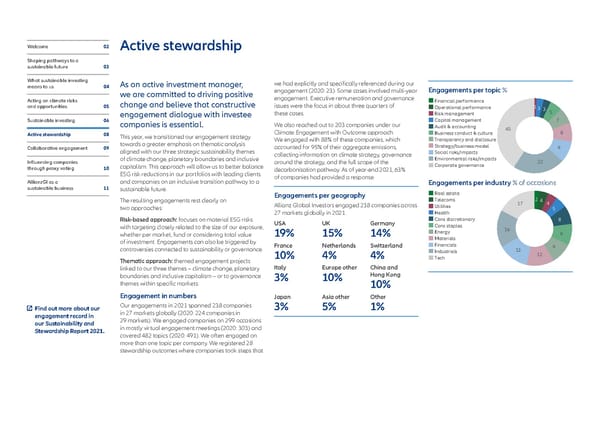

Welcome 02 Active stewardship Shaping pathways to a sustainable future 03 What sustainable investing As an active investment manager, we had explicitly and specifically referenced during our means to us 04 engagement (2020: 23). Some cases involved multi-year Engagements per topic % we are committed to driving positive engagement. Executive remuneration and governance Acting on climate risks change and believe that constructive Financial performance and opportunities 05 issues were the focus in about three quarters of Operational performance 13 3 engagement dialogue with investee these cases. Risk management 5 Sustainable investing 06 companies is essential. We also reached out to 203 companies under our Capital management 7 Audit & accounting 40 Active stewardship 08 This year, we transitioned our engagement strategy Climate Engagement with Outcome approach. Business conduct & culture 8 towards a greater emphasis on thematic analysis We engaged with 88% of these companies, which Transparency and disclosure Collaborative engagement 09 accounted for 95% of their aggregate emissions, Strategy/business model 9 aligned with our three strategic sustainability themes collecting information on climate strategy, governance Social risks/impacts Influencing companies of climate change, planetary boundaries and inclusive around the strategy, and the full scope of the Enironmental risks/impacts 22 through proxy voting 10 capitalism. This approach will allow us to better balance decarbonisation pathway. As of year-end 2021, 63% Corporate goernance ESG risk reductions in our portfolios with leading clients of companies had provided a response. AllianzGI as a and companies on an inclusive transition pathway to a Engagements per industry % of occasions sustainable business 11 sustainable future. Engagements per geography Real estate The resulting engagements rest clearly on Telecoms 17 2 4 4 two approaches: Allianz Global Investors engaged 238 companies across Utilities 5 27 markets globally in 2021. Health Risk-based approach: focuses on material ESG risks USA UK Germany Cons discretionary 8 with targeting closely related to the size of our exposure, Cons staples 16 whether per market, fund or considering total value 19% 15% 14% Energy 9 of investment. Engagements can also be triggered by Materials controversies connected to sustainability or governance. France Netherlands Switzerland Financials 9 Industrials 13 10% 4% 4% Tech 12 Thematic approach: themed engagement projects linked to our three themes – climate change, planetary Italy Europe other China and boundaries and inclusive capitalism – or to governance 3% 10% Hong Kong themes within specific markets. 10% Engagement in numbers Japan Asia other Other Find out more about our Our engagements in 2021 spanned 238 companies 3% 5% 1% engagement record in in 27 markets globally (2020: 224 companies in our Sustainability and 29 markets). We engaged companies on 299 occasions Stewardship Report 2021. in mostly virtual engagement meetings (2020: 303) and covered 482 topics (2020: 491). We often engaged on more than one topic per company. We registered 28 stewardship outcomes where companies took steps that

Welcome 02 Collaborative engagement Shaping pathways to a sustainable future 03 What sustainable investing Collaboration with other investors Ceres Food Emissions 50 UK Investor Forum means to us 04 offers an effective way to achieve The food sector is closely linked with climate change as We value engagements facilitated by the UK Acting on climate risks engagement objectives in the best the global food system is responsible for approximately Investor Forum on issues related to business strategy, and opportunities 05 5 interests of our clients and shape one third of all global GHG emissions . Recognising the environmental concerns, management of social risks Sustainable investing 06 intersection between food production and climate as and board oversight, among other topics. These sustainable pathways for the future. an important engagement area, we joined the Food engagements were particularly important given the Active stewardship 08 Emissions 50 effort co-ordinated by Ceres. As part of our level of activity in the UK market where access to capital Collaboration is particularly important when we have involvement, we joined the working group on land use and potentially undervalued assets has resulted in a Collaborative engagement 09 major concerns but only small holdings; we can have and climate. material number of takeover bids. a greater impact by working together. While we led Influencing companies the majority of our engagements ourselves in 2021, through proxy voting 10 we undertook several collaborative engagements with a focus on climate issues and governance and joined AllianzGI as a industry initiatives to promote the robust functioning sustainable business 11 of markets. Our intention is to expand and intensify collaborative engagement activities. In 2021, these engagements included: Climate Action 100+ As a member of Climate Action 100+, we supported a collaborative engagement letter that asked a US company to add a discussion item to its annual general meeting (AGM) agenda about its climate change commitments, as well as adopting a routine advisory vote on its climate strategy. Read about how we’re promoting gender diversity via collective engagement in our Sustainability and Stewardship Report 2021. 5 https://www.ceres.org/climate/ambition2030/food-emissions-50

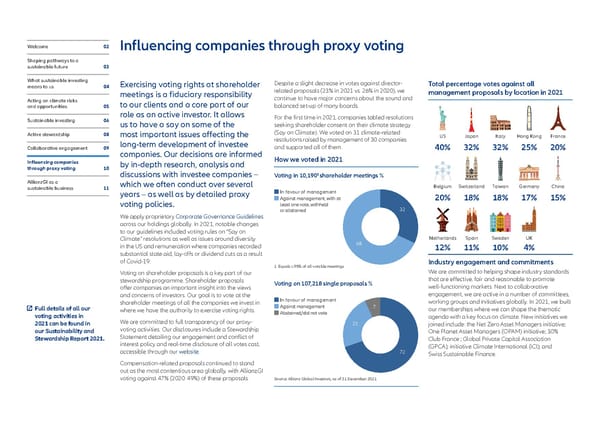

Welcome 02 Influencing companies through proxy voting Shaping pathways to a sustainable future 03 What sustainable investing Exercising voting rights at shareholder Despite a slight decrease in votes against director- Total percentage votes against all means to us 04 related proposals (23% in 2021 vs. 26% in 2020), we meetings is a fiduciary responsibility management proposals by location in 2021 Acting on climate risks to our clients and a core part of our continue to have major concerns about the sound and and opportunities 05 balanced set-up of many boards. role as an active investor. It allows For the first time in 2021, companies tabled resolutions Sustainable investing 06 us to have a say on some of the seeking shareholder consent on their climate strategy Active stewardship 08 most important issues affecting the (Say on Climate). We voted on 31 climate-related US Japan Italy Hong Kong France long-term development of investee resolutions raised by management of 30 companies Collaborative engagement 09 and supported all of them. 40% 32% 32% 25% 20% companies. Our decisions are informed How we voted in 2021 Influencing companies by in-depth research, analysis and through proxy voting 10 discussions with investee companies – 1 Voting in 10,190 shareholder meetings % AllianzGI as a which we often conduct over several Belgium Switzerland Taiwan Germany China sustainable business 11 years – as well as by detailed proxy In favour of management Against management, with at 20% 18% 18% 17% 15% voting policies. least one vote, withheld or abstained 32 We apply proprietary Corporate Governance Guidelines across our holdings globally. In 2021, notable changes to our guidelines included voting rules on “Say on Climate” resolutions as well as issues around diversity Netherlands Spain Sweden UK in the US and remuneration where companies recorded 68 12% 11% 10% 4% substantial state aid, lay-offs or dividend cuts as a result of Covid-19. Industry engagement and commitments 1 Equals c.95% of all votable meetings Voting on shareholder proposals is a key part of our We are committed to helping shape industry standards stewardship programme. Shareholder proposals Voting on 107,218 single proposals % that are effective, fair and reasonable to promote offer companies an important insight into the views well-functioning markets. Next to collaborative and concerns of investors. Our goal is to vote at the engagement, we are active in a number of committees, shareholder meetings of all the companies we invest in In favour of management working groups and initiatives globally. In 2021, we built Full details of all our where we have the authority to exercise voting rights. Against management 7 our memberships where we can shape the thematic voting activities in Abstained/did not vote agenda with a key focus on climate. New initiatives we 2021 can be found in We are committed to full transparency of our proxy- 21 joined include: the Net Zero Asset Managers initiative; our Sustainability and voting activities. Our disclosures include a Stewardship One Planet Asset Managers (OPAM) initiative; 30% Stewardship Report 2021. Statement detailing our engagement and conflict of Club France ; Global Private Capital Association interest policy and real-time disclosure of all votes cast, (GPCA); initiative Climate International (iCI); and accessible through our website. 72 Swiss Sustainable Finance. Compensation-related proposals continued to stand out as the most contentious area globally, with AllianzGI voting against 47% (2020: 49%) of these proposals. Source: Allianz Global Investors, as of 31 December 2021

Welcome 02 AllianzGI as a sustainable business Shaping pathways to a sustainable future 03 What sustainable investing Trust in our company is based on the Workplace: Building a work culture that Fostering employee health and wellbeing means to us 04 enhances psychological safety integrity, resilience and competency We strive to provide a caring work environment where Acting on climate risks of how we do business as well as on 2021 was a year of significant organisational change our employees are supported to balance work, career and opportunities 05 as we managed the impacts of the pandemic and development and personal priorities. We consider the our culture and how it is brought to built strong foundations for a more inclusive workplace causes of stress and depression so that we can promote Sustainable investing 06 life by all colleagues. We are shaping culture. We introduced Rungway, an online platform good mental health, and offer advice on topics such as Active stewardship 08 our pathway to a more sustainable offering a safe space for colleagues to seek advice nutrition, sleep or managing work-life balance. future by focusing on our own and help from others. We also revamped our anti- Our Employee Assistance Programme (EAP) offers Collaborative engagement 09 harassment and anti-discrimination policy and training, free and confidential support for employees and operations in addition to those of the which will be implemented globally in 2022. their families and the new Health and Wellbeing Influencing companies companies we invest in. Workforce: Attracting, developing and retaining Hub provides resources to nurture a healthy mind, through proxy voting 10 a diverse range of people body and self. AllianzGI as a Promoting inclusive meritocracy – We aim to attract and develop a large variety of talents sustainable business 11 where people and performance matter to grow the diversity of our employees at all levels, Prompting flexible work opportunities Inclusive meritocracy describes a corporate culture including senior leadership, paying special attention to We refreshed global guidelines for flexible working of mutual trust and respect, empowerment and gender, ethnicity, sexual orientation and disability. in 2021, having offered employees the opportunity to collaboration. The Inclusive Meritocracy Index (IMIX) – a work flexibly in terms of time or place for several years. key index in our annual employee engagement survey – We have reached 50:50 male to female representation Subject to compliance with local and international measures the progress we are making across 10 aspects in the ExCo while at other levels we still have work to tax, social security and immigration regulations, covering leadership, performance and corporate do. In line with Allianz Group’s targets for 2024, our employees can now work abroad for up to 25 days in culture. Our 2021 employee survey showed positive ambition is to achieve a global female representation a calendar year. developments with a +6% improved IMIX score. of a minimum of 30% across all senior levels. The Covid-19 pandemic has prompted us to extend Developing a shared vision for inclusion Marketplace: Embedding I&D in our wider our focus beyond how work should be done to and diversity social purpose look at what is needed for people to be happy and Our focus on inclusion and diversity (I&D) shapes Our firm can be a powerful force in increasing productive. Alongside our parent company Allianz, we how we work and serve our large and varied client investment in assets, products and businesses that help have launched “Ways of Working” (WOW) – a global base. An inclusive culture can contribute to improved the world become more sustainable and equitable. This framework designed to ensure that Allianz possesses investment performance and create long-term value third pillar of our I&D strategy is about leveraging our the characteristics that will be needed for future growth. Read the full story in for our clients and society. I&D values to strengthen our positive impact on society. our Sustainability and We will develop our strategic approach in this area in Stewardship 2021. Our I&D strategy is led by our Executive Committee the coming years to build on the many initiatives already (ExCo) and delivered by working groups of employees in place. across our locations. It focuses on three key pillars – Workplace, Workforce and Marketplace – to create meaningful change and embed I&D behaviours into our business.

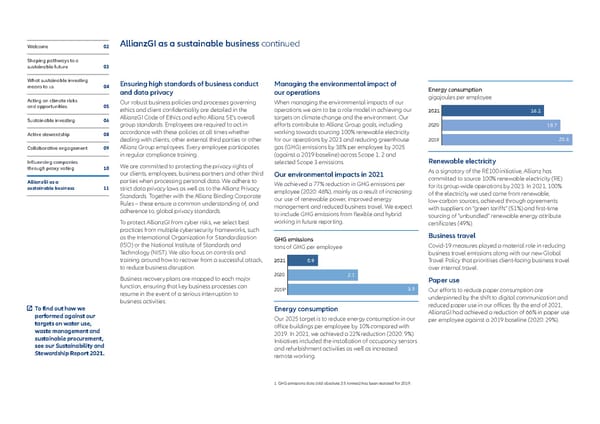

Welcome 02 AllianzGI as a sustainable business continued Shaping pathways to a sustainable future 03 What sustainable investing Ensuring high standards of business conduct Managing the environmental impact of means to us 04 Energy consumption and data privacy our operations gigajoules per employee Acting on climate risks Our robust business policies and processes governing When managing the environmental impacts of our and opportunities 05 ethics and client confidentiality are detailed in the operations we aim to be a role model in achieving our 2021 16.1 Sustainable investing 06 AllianzGI Code of Ethics and echo Allianz SE’s overall targets on climate change and the environment. Our group standards. Employees are required to act in efforts contribute to Allianz Group goals, including 2020 18.7 Active stewardship 08 accordance with these policies at all times whether working towards sourcing 100% renewable electricity dealing with clients, other external third parties or other for our operations by 2023 and reducing greenhouse 2019 20.6 Collaborative engagement 09 Allianz Group employees. Every employee participates gas (GHG) emissions by 38% per employee by 2025 in regular compliance training. (against a 2019 baseline) across Scope 1, 2 and Influencing companies We are committed to protecting the privacy rights of selected Scope 3 emissions. Renewable electricity through proxy voting 10 As a signatory of the RE100 initiative, Allianz has our clients, employees, business partners and other third Our environmental impacts in 2021 committed to source 100% renewable electricity (RE) AllianzGI as a parties when processing personal data. We adhere to We achieved a 77% reduction in GHG emissions per for its group-wide operations by 2023. In 2021, 100% sustainable business 11 strict data privacy laws as well as to the Allianz Privacy employee (2020: 46%), mainly as a result of increasing Standards. Together with the Allianz Binding Corporate of the electricity we used came from renewable, Rules – these ensure a common understanding of, and our use of renewable power, improved energy low-carbon sources, achieved through agreements adherence to, global privacy standards. management and reduced business travel. We expect with suppliers on “green tariffs” (51%) and first-time to include GHG emissions from flexible and hybrid sourcing of “unbundled” renewable energy attribute To protect AllianzGI from cyber risks, we select best working in future reporting. certificates (49%). practices from multiple cybersecurity frameworks, such Business travel as the International Organization for Standardization GHG emissions (ISO) or the National Institute of Standards and tons of GHG per employee Covid-19 measures played a material role in reducing Technology (NIST). We also focus on controls and business travel emissions along with our new Global training around how to recover from a successful attack, 2021 0.9 Travel Policy that prioritises client-facing business travel to reduce business disruption. over internal travel. Business recovery plans are mapped to each major 2020 2.1 Paper use function, ensuring that key business processes can 20191 3.9 Our efforts to reduce paper consumption are resume in the event of a serious interruption to underpinned by the shift to digital communication and business activities. reduced paper use in our offices. By the end of 2021, To find out how we Energy consumption AllianzGI had achieved a reduction of 66% in paper use performed against our Our 2025 target is to reduce energy consumption in our per employee against a 2019 baseline (2020: 29%). targets on water use, office buildings per employee by 10% compared with waste management and 2019. In 2021, we achieved a 22% reduction (2020: 9%). sustainable procurement, Initiatives included the installation of occupancy sensors see our Sustainability and and refurbishment activities as well as increased Stewardship Report 2021. remote working. 1 GHG emissions data (old absolute 3.5 tonnes) has been restated for 2019.

Welcome 02 AllianzGI as a sustainable business continued Shaping pathways to a sustainable future 03 What sustainable investing Corporate citizenship means to us 04 Beyond our core operations and sustainable investing, Acting on climate risks we seek to use our resources and employee skills to and opportunities 05 have a positive impact on our communities. We support Sustainable investing 06 initiatives local to our operations with a focus on those that align with the UN SDGs. Active stewardship 08 Examples include: Collaborative engagement 09 – Childr en’s charities in Germany, Hong Kong, Japan, Singapore, Taiwan and the US with priorities such as Influencing companies health, education, and children’s rights through proxy voting 10 – Or ganisations fighting poverty in France, US AllianzGI as a and Singapore sustainable business 11 – Pr ojects helping to provide food to disadvantaged communities in France, Germany, Peru, Hong Kong, Italy, Singapore and the UK – Initiatives working with childr en and adults with disabilities in Hong Kong, Japan and Luxembourg – Charities fighting homelessness in the US – Or ganisations promoting environmental protection in China and Taiwan. Shaping a new generation of innovation with Enactus In our second year of collaboration as a gold member of Enactus Germany, we worked with students to support activities that target the UN SDGs through our Find out more about sponsorship of the “Start-up Accelerator” in November our approach to 2021. We share the passion of the students engaged corporate citizenship in in Enactus networks on their journey to create a better our Sustainability and world through innovation and entrepreneurial action. Stewardship Report 2021.

Imprint Project responsibility Copyright © Allianz Global Investors 2022 Kathrin Beck, Sustainable and Impact Investing Publisher John Bolton, Content Management Allianz Global Investors GmbH Jon Cudby, Content Management Bockenheimer Landstr. 42–44 Design, concept and production 60323 Frankfurt Germany Radley Yeldar, London, U.K. allianzgi.com/sustainability ry.com Editor-in-chief We would like to thank all of our colleagues and Matt Christensen, Global Head of Sustainable partners who have helped us to create this report. and Impact Investing Date of publication: April 2022 Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security. The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted. This material has not been reviewed by any regulatory authorities. In mainland China, it is for Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations and is for information purpose only. This document does not constitute a public offer by virtue of Act Number 26.831 of the Argentine Republic and General Resolution No. 622/2013 of the NSC. This communication’s sole purpose is to inform and does not under any circumstance constitute promotion or publicity of Allianz Global Investors products and/or services in Colombia or to Colombian residents pursuant to part 4 of Decree 2555 of 2010. This communication does not in any way aim to directly or indirectly initiate the purchase of a product or the provision of a service offered by Allianz Global Investors. Via reception of his document, each resident in Colombia acknowledges and accepts to have contacted Allianz Global Investors via their own initiative and that the communication under no circumstances does not arise from any promotional or marketing activities carried out by Allianz Global Investors. Colombian residents accept that accessing any type of social network page of Allianz Global Investors is done under their own responsibility and initiative and are aware that they may access specific information on the products and services of Allianz Global Investors. This communication is strictly private and confidential and may not be reproduced. This communication does not constitute a public offer of securities in Colombia pursuant to the public offer regulation set forth in Decree 2555 of 2010. This communication and the information provided herein should not be considered a solicitation or an offer by Allianz Global Investors or its affiliates to provide any financial products in Brazil, Panama, Peru, and Uruguay. In Australia, this material is presented by Allianz Global Investors Asia Pacific Limited (“AllianzGI AP”) and is intended for the use of investment consultants and other institutional/professional investors only, and is not directed to the public or individual retail investors. AllianzGI AP is not licensed to provide financial services to retail clients in Australia. AllianzGI AP is exempt from the requirement to hold an Australian Foreign Financial Service License under the Corporations Act 2001 (Cth) pursuant to ASIC Class Order (CO 03/1103) with respect to the provision of financial services to wholesale clients only. AllianzGI AP is licensed and regulated by Hong Kong Securities and Futures Commission under Hong Kong laws, which differ from Australian laws. This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors U.S. LLC, an investment adviser registered with the U.S. Securities and Exchange Commission; Allianz Global Investors Distributors LLC, distributor registered with FINRA, is affiliated with Allianz Global Investors U.S. LLC; Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG; in HK, by Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; in Singapore, by Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore Company Registration No. 199907169Z; in Japan, by Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424, Member of Japan Investment Advisers Association, the Investment Trust Association, Japan and Type II Financial Instruments Firms Association; in Taiwan, by Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan; and in Indonesia, by PT. Allianz Global Investors Asset Management Indonesia licensed by Indonesia Financial Services Authority (OJK). 2106563

Allianz Global Investors Global Head of Sustainable and Impact Investing 3 Boulevard des Italiens 75002 Paris France www.allianzgi.com/sustainability