Sustainability & Stewardship Report | AllianzGI

Contents Introduction 03 Active stewardship About this report 02 How to read this report 03 03.1 Developing our 62 engagement strategy Welcome from our CEO 04 03.2 How we engage 64 In conversation with our Global Head 06 03.3 AllianzGI’s engagement 69 of Investments and Global Head of in numbers Sustainable and Impact Investing About Allianz Global Investors 09 03.4 Engagement outcomes 72 03.5 Collaborative engagements 82 01 Our sustainability approach 03.6 Escalating engagement concerns 84 01.1 Evolving our strategic approach 13 03.7 Exercising our voting rights 86 01.2 Strengthening sustainability 18 03.8 Transparently managing 95 governance conflicts of interest 01.3 Guiding clients on sustainable 23 03.9 Industry engagement 97 investment solutions and commitments 02 Sustainable investing 04 Corporate sustainability 02.1 Evolving our approach to 32 04.1 Strengthening our corporate 100 sustainable investing sustainability strategy 02.2 Sustainability research 34 04.2 Creating an inclusive and 103 supportive workplace 02.3 Sustainability methodologies 39 04.3 Ensuring responsible 110 and analytics business conduct 02.4 Climate-related risks 43 04.4 Managing the environmental 114 and opportunities impact of our operations 02.5 Sustainability risk management 45 04.5 Driving our corporate citizenship 119 02.6 Sustainable investing categories 46 05 Appendix 01

This is a modal window.

Introduction About this report We began our sustainable investing Report scope and boundaries journey over 20 years ago and published The content of this report relates to our first Responsible Investing Report all AllianzGI activities and locations. in 2018. Our sustainability reporting All measures, activities and figures refer now incorporates our investment to the 2022 fiscal year (1 January 2022 to activities and commitment to active 31 December 2022) unless otherwise stated. stewardship with our stakeholders. We have included an expanded section Find out more on corporate sustainability that features Read more about our approach to more details of our work on embedding sustainability and explore our latest environmental, social and governance research on our website, where you will (ESG) practices in our business operations, find key policy documents and reports, and engagement with our communities including our latest Task Force on and society. Our reporting journey reflects Climate-related Financial Disclosures the broader shift from sustainability (TCFD) Report. commitments to progress, with the onus on demonstrating tangible change and For information on the sustainability real-world impact. commitments and performance of Allianz, please refer to the Allianz Group This Sustainability and Stewardship Sustainability Report 2022. Report showcases our sustainable investment and corporate sustainability AllianzGI website. beliefs and capabilities. The content is AllianzGI TCFD Report. Allianz Global Investors (AllianzGI) is an active also intended to renew our admission to investment management firm and part of the UK Stewardship Code, one of the most AllianzGI Diversity, Equity and Allianz Group. Sustainable investing is a core important external accreditations of our Inclusion Report 2022. part of our strategy to shape pathways towards stewardship activities. Being a signatory of the Stewardship Code is an increasing Allianz Group Sustainability change that secure the future for our clients, priority for institutional investors when Report 2022. our business and society. considering partners. Allianz Global Investors Sustainability and Stewardship Report 2022 02

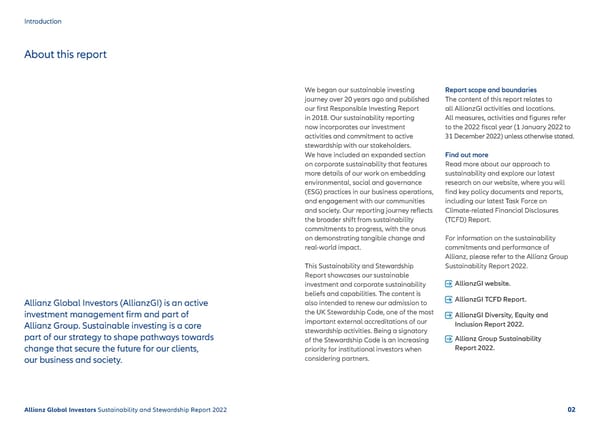

Introduction How to read this report Our Sustainability and Stewardship Report 2022 has four sections plus an appendix, which together reflect our commitment to sustainable investing, active stewardship and corporate sustainability. Hear from our CEO, our Global Head of Investments and our Global Head of Sustainable and Impact Investing about the Introduction events that impacted us over the last year and how we are evolving our approach. Find out how we are evolving our strategic approach from Our sustainability ESG to sustainability to impact, and from sustainability approach commitments to progress. Read about how our investment offering and active approach Sustainable aim to position us as a shaper of sustainable investing solutions investing across public and private markets. Understand our guiding themes – climate change, Active planetary boundaries, and inclusive capitalism – and how stewardship they impact our active approach to engagement and voting. Learn how we are increasing our efforts to benefit employees, Corporate communities and the environment, and how we manage risk sustainability and ensure compliance across our business. UK Stewardship Code indexing Principle 1 Throughout the report, we mark content that specifically addresses the Principles of the UK Stewardship Code. Principles 2 3 A full index is included on page 123. Allianz Global Investors Sustainability and Stewardship Report 2022 03

This is a modal window.

Introduction Welcome from our CEO, Tobias Pross Welcome to Allianz Global Investors’ 2022 With devastating floods in Pakistan, Sustainability and Stewardship Report South Asia, Malaysia and West Africa, as we reflect on an extraordinary year and heatwaves and drought in Europe, for investors. This is the second year that China and Africa, the year 2022 gave we have combined our sustainability and clear signs of the potential impacts of stewardship reporting in a single report to climate change. provide a holistic view of our commitments and achievements. Our focus this year was AllianzGI’s culture principles – including on emerging from the Covid-19 pandemic putting clients first, being solution-oriented better, stronger and more resilient. and being sustainable in everything But on top of that, we faced unexpected that we do – underpin our commitment. market turbulence driven by the war While our strategic ambition remains in Ukraine and geopolitical instability. the same, with sustainability as a key The impacts have been wide ranging, pillar, our approach is evolving. We have spanning energy security, transition and moved beyond simply incorporating affordability, inflation, rising interest rates, environmental, social and governance supply chain issues and challenging equity (ESG) risk factors into portfolios to think and bond markets. more holistically about sustainability across investment portfolios. These challenges have huge implications for the investment community. But while Our ultimate destination is to be able to investors’ commitment to sustainable achieve and show the true impact of these investing may have been tested, our view investments. This shift is the foundation remains the same. We believe sustainable of our strategic journey from ESG to investing is every bit as crucial to the sustainability to impact by 2030. You can resilience of asset owners, investors, read more about how we are developing the wider industry, and society as a whole. outcome-oriented impact solutions for investors in section 02 of this report. Allianz Global Investors Sustainability and Stewardship Report 2022 04

Introduction Welcome from our CEO, Tobias Pross Despite a major focus on managing In July 2022, we completed the transfer market volatility this year, we have made of certain US investment teams and the good progress in integrating sustainability assets they manage to Voya Investment into our various activities – from our Management as part of our strategic investment capabilities to our business partnership. We are grateful to regulators, operations. It is our continued investment colleagues and clients who made this in expertise and people that allows us to possible and look forward to making the develop new products and approaches, most of the opportunities presented by alongside transitioning existing products this partnership. to be more aligned with sustainable investing. We have also started the roll- Volatility seems set to be a continued out of our proprietary sustainability data companion in 2023, presenting challenges architecture to inform, shape and track and opportunities. Inflation remains a sustainable investment decisions across all concern for everyone – both firms and asset classes. individuals – and the impact of slower growth will be felt to varying degrees We have created a new role to focus on around the world. Geopolitics will corporate sustainability, underscoring the continue to impact economic decisions, firm-wide commitment to sustainability that reiterating the crucial need to maintain is key to delivering on our clients’ priorities – the focus on sustainable investing to from reducing emissions to supporting local generate value for asset owners and communities as part of the global social society, elevate the investment experience impact approach of the Allianz Group. and protect and enhance clients’ assets See section 04 of this report for over the long term. more details. In this context, our commitment to shaping Protecting our offering to clients by being sustainable pathways will focus on compliant with regulation is critical for all addressing the diversity of client needs new and existing products, and we are through leadership and collaboration constantly learning and evolving at pace as we continue to evolve our holistic in response to developments in regulation. approach to sustainability. Allianz Global Investors Sustainability and Stewardship Report 2022 05

This is a modal window.

Introduction In conversation with our Global Head of Investments Principle 1 and Global Head of Sustainable and Impact Investing 2022 was an extraordinary to quality raw data. This has made it one year for investors. How has of the most extraordinary years, not just investor appetite for sustainability in terms of the data we had to source and transparency been impacted by but also the need for engagement to the events of the year? supplement this data. 2022 was certainly a year during which sustainability was tested What does being a sustainability and, in our view, came of age. The onset shaper mean for AllianzGI? of the war in Ukraine was a defining We are the guardians of the capital event of the year, and the conflict sparked and savings of a wide range implications far beyond its geographic of people, from younger generations footprint. We saw an energy crisis in to grandparents. They want to do the Europe and global food supply volatility right thing for the future, and they also alongside climate-related weather have to meet their needs now. Being a events. This has tested both markets and sustainability shaper means addressing investor commitments to sustainability, these dual needs by keeping the but it has also brought a new level spotlight firmly on seeking to deliver of realism about what sustainable financial outperformance while building investing needs to achieve and how it our sustainable offerings and future- is measured. The transition has been proofing our investments. Allianz, our aided by regulation that sets a high parent company, is vocal on its stance on bar for what qualifies as sustainable. sustainability as a company and what it Clients are rightly seeing the European brings to the world in terms of net zero as Deborah Zurkow Union’s SFDR Article 81 as the minimum a founding member of the Net-Zero Asset Global Head of Investments commitment for sustainable products, Owner Alliance. At AllianzGI, we’ve seen and data and insights are increasingly a step change in our sustainability critical in reconciling their desire for commitments since 2020, consistent with both financial returns and sustainable our belief that we have a role to play in Matt Christensen outcomes. Across the industry we’ve seen shaping future outcomes. Doing good Global Head of Sustainable historic methodologies called out as part for the world also involves being fiscally and Impact Investing of the move from opaque scoring systems responsible and avoiding stranded assets 1 Sustainable Finance Disclosure Regulation – Article 8. Defined as “a fund which promotes, among other characteristics, environmental or social characteristics, or a combination of those characteristics, provided that the companies in which the investments are made follow good governance practices.” Allianz Global Investors Sustainability and Stewardship Report 2022 06

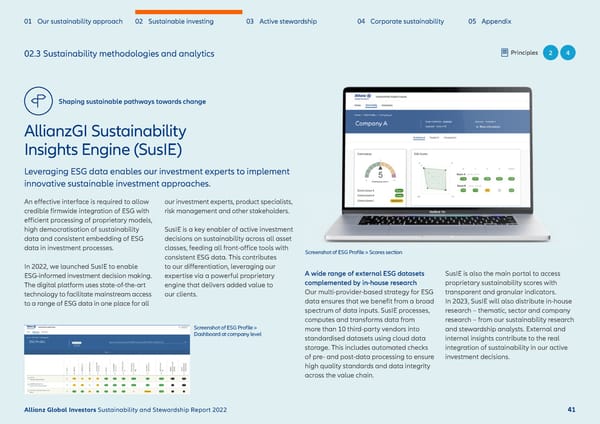

Introduction In conversation with our Global Head of Investments Principle 1 and Global Head of Sustainable and Impact Investing by staying ahead of where investors and classic example, whereby we develop a sustainability and financial performance We made research a key part of financing priorities are going. It means portfolio not just based on managing ESG in a portfolio. There’s a growing number of our team for a reason, starting with being innovative with how we create risk but on aiming to deliver outcomes different sources of sustainability data and defining what ESG factors are key for each and funnel investments. And it requires that support the pathway to net zero. it can be difficult to reconcile these sources sector in order to feed the development of strengthening our focus on corporate Beyond sustainability considerations, impact into meaningful insights. That is why we new data analytics software. The launch sustainability and ensuring all our goes further by targeting measurable social have invested heavily in creating an ESG of SusIE, our Sustainability Insights Engine, employees can contribute, while holding or environmental benefits as well as an data architecture and platform that can represents a significant milestone for ourselves to the high standard of investment return. This is the most ambitious service our own ratings and screening, and our journey to create our own dataset governance that our stakeholders expect. level to achieve. It requires a portfolio enable us to look at markets and portfolios and processes to drive our sustainable manager to have a strong impact conviction, to determine how to push forward on performance. Now that the heavy lifting Can you describe what you and the opportunities can span both sustainability outcomes while aiming to has been done in creating the tool, the mean by the journey from ESG public and private markets. AllianzGI has maintain financial outperformance. next steps will be the addition of modules to sustainability to impact? developed an impact scoring framework for of stewardship and engagement in 2023. Beyond the big events we’ve seen in private market investing and an emerging the headlines this year, we think the body of industry standards is enabling more move from ESG to sustainability to impact accurate measurement and reporting for will be the long-term trend of the decade. impact investing. Over time, expect to see To explain, ESG is the foundation from which more portfolios being developed to meet a we must develop our long-term approach. range of goals, which will be well-defined It’s a base level of risk management that for investors from the outset. clients expect of sustainable investments in terms of assessing and filtering out risks. How are you addressing data Building on that, sustainability shifts the needed to support the journey? purpose from risk management towards The importance of data cannot be developing purposeful solutions that are overstated, in terms of delivering created to deliver outcomes needed by impact, keeping pace with regulation, and society, like those targeted by the United delivering financial returns. To be robust Nations’ Sustainable Development Goals in our approach to Article 8 funds, as (SDGs). This requires a solution mindset defined under the EU’s Sustainable Finance that uses ESG intelligence to solve the Disclosure Regulation, we need our own key challenges. Decarbonisation is a ratings and screening process to reconcile Allianz Global Investors Sustainability and Stewardship Report 2022 07

This is a modal window.

Introduction In conversation with our Global Head of Investments Principle 1 and Global Head of Sustainable and Impact Investing Alongside this, our new impact framework blended finance as an access point to the architecture and infrastructure to is being used on the equity and debt sides seek to address climate problems across deliver Article 8 and 9 solutions, and we of our private markets work, as well as at a the globe. Scale is key and blended are targeting a steady journey to achieve fund level to feed into our direct investing. finance as a technique is something we long-term scalability. need to pay attention to and draw in Innovation around funding is more investors. We’re already doing this in What do you predict we will see critical in delivering sustainability emerging markets and the same technique over the next few years in terms objectives. How do you see blended could be applied to developed markets. of sustainable investing? finance playing an increasing role in We are at an inflection point – as people We think demand for sustainable delivering sustainable, long-term impact? become more receptive to seeing the track products will increase dramatically We’ve focused over the past several record on these financings, we can start to with the accumulation of wealth in a years on our ambition to gather expect growth in interest from more third- generation that has been focused on more private markets funding around party investors. sustainability for longer than those climate and the needs of emerging of us who are closer to retirement. markets across the SDGs. Blended finance How is AllianzGI evolving its This is a change that has already started. is about directing private markets funding approach for a low-carbon future? One of the big challenges we will need into investments that have historically What we see happening with the to overcome is the issue of so much been the domain of development finance impact of events in Ukraine and the disparate regulation, which has created institutions (DFIs). In emerging markets, volatility of energy markets are tests along significant complexity. More consistency there often isn’t enough capital to fund the way as sustainable investing continues across regions would make it easier to infrastructure projects and the idea is that, to become mainstream. We must maintain invest in sustainable products in different by working together, private investors a long-term mindset and put our building places. Europe is on a forward roll and carry less risk and DFIs can make their blocks in place for the future we want collective will is not going away, as we money go much further. We’re also to shape. You cannot simply turn on the have both a bottom-up and a top-down increasingly involved in the equity and switch for a net zero system today, but you agreement about the critical importance debt side of blended finance in emerging can thoughtfully plan for tomorrow and of sustainable solutions. Overall, I’m very markets on projects that have a climate we are pragmatic about moving towards a positive about the trajectory we are on, change element. We have a tripartite lower-carbon world. Decarbonisation and and how we’re increasingly living and agreement with Allianz to see how we net zero alignment are complex, and breathing sustainability right across our can positively impact climate-related we are developing solutions which firm. Progress on sustainability takes outcomes. But an increasing number we believe are credible, practical and partnership and collaboration with clients, of third-party investors are looking at scalable. We’ve worked hard to set up colleagues, regulators, communities and all our other stakeholders. Allianz Global Investors Sustainability and Stewardship Report 2022 08

Introduction About Allianz Global Investors Principle 1 With a commitment to active Providing value for our clients means asset management, we seek to securing and protecting their long- 2022 highlights2 elevate the investment experience term wealth. We do this through our EUR 506 billion Our Executive and protect and enhance our commitment to personal client service and total assets under Committee (ExCo) is global and local market knowledge and management (AuM) 50% female clients’ assets over the long term. insights. This is reinforced by identifying (since 2020) long-term growth opportunities that align Allianz Global Investors (AllianzGI) is with our vision of a sustainable future. EUR 251 billion 100% of an active investment management of ESG risk-focused, employees firm and part of Allianz Group. With a Sustainability has evolved in the last sustainability-focused and completed the Global focus on managing assets and investing two decades to become an integral part impact-focused assets Compliance Training for the long term, we have more than of the AllianzGI investment philosophy. 600 investment professionals and 500 This is mirrored by our commitment to 250 sustainability 59% relationship managers working across embedding sustainability in our own analyses reduction in greenhouse 20 locations worldwide. We manage EUR operations. This echoes the purpose of completed on gas emissions per 506 billion of assets for institutions and our parent company, Allianz Group – companies worldwide employee (vs. 2019) 2 “We secure your future” – which prioritises individuals around the globe. Active stewardship: 100% tackling climate change, delivering social 438 engagements AllianzGI offers a diversified range of impact and ensuring sustainable growth. renewable active investment strategies across four covering 996 electricity in our offices main pillars: equities, fixed income, Generating value for our clients is at the core topics and local data centres multi asset and private markets across of our ethos as we aim to shape sustainable (since 2021) the Americas, Europe and Asia Pacific. pathways towards change. In practice, Greenwich Quality With this footprint, we combine expertise this means motivating inclusive sustainable Leader across public and private investments growth for our clients’ wealth generation and in developed and emerging markets preservation. To achieve this, we partner with in institutional and with our advisory services – delivered clients and other stakeholders to develop intermediary investment by our specialist risklab capabilities. innovative, forward-looking solutions and management in Asia and This enables us to guide clients in aligning seek opportunities for collaboration towards Continental Europe3 their sustainability values and their real world impact. investment objectives. 2 Data as at 31 December 2022. 3 Coalition Greenwich, 2022. Allianz Global Investors Sustainability and Stewardship Report 2022 09

Introduction About Allianz Global Investors Principles 1 6 Our five business objectives To achieve this, we focus on five principal Foster a fulfilling work Together with our clients, employees business objectives: environment for employees and other stakeholders, we aim to drive 3We motivate our people by lasting change by using our expertise, Generate strong investment fostering a merit-based, values-driven, influence and impact-focused investing returns for our clients inclusive culture and providing the right We motivate our across the entire investment value chain. 1We measure our strategies’ technology and support. The annual We approach this with a long-term asset-weighted performance against their Allianz Engagement Survey is our main people by fostering perspective because our active strategies benchmarks over one-year, three-year and tool for assessing employee satisfaction can take a longer-term view and align five-year periods, the time horizons defined and we use the results to highlight where a merit-based, with the time horizon of our clients, as well to us by our clients. We also track how we need to improve. as the trends reshaping markets. strategies are performing against peers. values-driven, Grow our company inclusive culture. Provide excellent client service organically and sustainably We measure client satisfaction 4We measure our growth in 2through an annual survey carried terms of revenues and net cash flow out by independent research consultants to gauge the extent to which we are Coalition Greenwich. It assesses how our offering clients the most relevant and institutional and intermediary clients view attractive capabilities. our investment and client services. We aim to achieve first-quartile performance and Generate profitable growth we use the feedback to identify areas for our shareholders where we can strengthen our offerings. 5All five objectives are interlinked. Since 2018, Coalition Greenwich has also By serving our clients well and motivating conducted client interviews to measure our employees to excel, we believe our clients’ perception of our sustainable company will grow sustainably and deliver investing capabilities. Through our client strong results for our shareholders over forums in select markets, we promote the long term. two-way feedback and shared learnings. Allianz Global Investors Sustainability and Stewardship Report 2022 10

Introduction About Allianz Global Investors Principle 1 Shaping sustainable pathways as Our culture principles alongside positive change. These culture a responsible business Our culture principles – set out below – principles describe behavioural We see embedding sustainability inspire sustainable behaviours and foster expectations and aspirations towards as the role of everyone at AllianzGI, a working environment that supports AllianzGI employees and are consistent because it is intrinsic to our success as our strategy to be first choice for savers with our corporate values. an active investor and our function as and investors who seek financial returns a responsible business. Our values Our culture principles Our company values – excellence, Put the Take integrity, respect, and passion – describe client first ownership how we want to conduct our business. of the final outcome They underpin our commitment to being sustainable across all our activities and in our stewardship approach. Be Think outside the box sustainable and embrace failure as a • Excellence in operations drives us in everything we do learning opportunity to optimise our ways of working and reduce emissions. Be Win together as a • Respect confirms our commitment to solution- oriented team develop long-term relations with clients, providers and colleagues. • Integrity requires holding ourselves Be to standards over and above courageous compliance requirements. • Passion means we apply ourselves and make tough choices consistently in the face of both success and adversity. Allianz Global Investors Sustainability and Stewardship Report 2022 11

01 Our sustainability approach 02 Sustainable investing 03 Active stewardship 04 Corporate sustainability 05 Appendix 01 Our sustainability approach This year’s report focuses on how we are shaping pathways towards change. This reflects our direction of travel as an active investor from ESG to sustainability to impact, and a broader shift in sustainability from commitments to progress, to clearly demonstrate tangible change. Principle 1 12

01 Our sustainability approach 02 Sustainable investing 03 Active stewardship 04 Corporate sustainability 05 Appendix 01.1 Evolving our strategic approach Principles 1 9 01.1.1 What sustainability Corporate sustainability at AllianzGI Allianz – and their trust is fundamental to means to us We are elevating the importance of our social licence to operate. This means Our commitment to shaping sustainable corporate sustainability as a driver for we must be transparent in how we pathways addresses client needs sustainable growth in the face of the communicate our successes and failures alongside the needs of society and our climate crisis and societal challenges. as we continue to learn and evolve planet. To be a sustainability shaper, In driving sustainable pathways towards our approach. we must take a holistic approach. change, we must go beyond our focus on of institutional investors say the resilience and long-term growth of Over the course of 2022, we continued they now subject ESG to the Sustainability and sustainable investing clients’ assets and aim for the same deep to enhance the sustainability function same scrutiny as operational are complex and wide-ranging. We are scrutiny and due diligence to our own with a dedicated focus on corporate and financial considerations. constantly learning and testing innovative impact as a company. This is how we will sustainability and a mandate from our approaches and forging partnerships. continue to embed trust in the AllianzGI Executive Committee to deliver long-term In May 2022, Allianz SE announced brand as a corporate citizen and a business value without compromising the resolution of US governmental Being a sustainable and resilient business responsible steward of assets. people, planet or profit. This means taking investigations concerning our Structured is an essential part of this journey, a balanced and forward-looking approach Alpha funds with a guilty plea by Allianz alongside driving sustainable growth Stakeholders are demanding increased that demonstrates social accountability Global Investors US. Following heavy losses through investing. Innovation is key corporate responsiveness on sustainability, and a commitment to transparent in the funds during the Covid-19 market and we constantly learn as we progress and complex legal and enterprise reporting, partnerships and engagement. turmoil, we fully cooperated with from an ESG focus to sustainability risk issues require a more defined and investigations by US authorities. It became and on towards real-world impact sophisticated approach. According to At the core of our approach is a apparent that three former employees 1 manipulated numerous bespoke client across our three strategic focus areas of the latest Edelman Trust Barometer , commitment to inclusive meritocracy – climate change, planetary boundaries, public trust in business is declining in building and enhancing a culture and communications to understate the risk of and inclusive capitalism. several countries, including Germany, working environment where people and portfolios. As soon as the misconduct was See visual on page 15. and 88% of institutional investors say they performance matter. We promote a established, we took quick and forceful now subject ESG to the same scrutiny as culture that is built on mutual trust and action. We continue to implement targeted operational and financial considerations. respect, empowerment and collaboration. enhancements to further strengthen We foster diversity and client satisfaction as oversight, investment analytics and client We are accountable to all our top priorities, along with the environmental communication controls. stakeholders – including clients, management of our operations and employees, societal partners, philanthropic engagement with local regulators and our parent company, communities and wider society. 1 https://www.edelman.com/trust/2021-trust-barometer/investor-trust. 13

01 Our sustainability approach 02 Sustainable investing 03 Active stewardship 04 Corporate sustainability 05 Appendix 01.1 Evolving our strategic approach Principles 1 4 9 Ensuring regulatory compliance and Our approach to sustainable investing We seek to inform, not prescribe, the ESG, extreme weather events as the second organisational resilience is key. We are We aim to simplify the complexities of sustainability and climate profile of greatest risk after the cost of living. developing harmonised, visible and sustainable investing by guiding investee companies. Our aim is to Over the next 10 years, the report transparent processes to simplify, and partnering with clients and motivate inclusive sustainable growth by identifies the top three risks as failure scale and enhance process quality other stakeholders to offer effective actively partnering for forward-looking to mitigate climate change, failure of and efficiency. It is essential that our solutions that address diverse solutions and creating real-life change climate change adaptation, and natural leaders have the right knowledge, investment objectives. through collective action. disasters and extreme weather events. experience, professional qualifications, In fourth position is biodiversity loss integrity and soundness of judgement. Our sustainable investing philosophy This includes responding to regulatory and ecosystem collapse. We see these We also need every employee to have the centres around an investee entity’s demands and challenging climate risks as closely interdependent and this understanding and capabilities to meet future “operating and financial and geopolitical events. The World view underpins our holistic approach to our standards. That is why compliance is resilience” in evolving economic and Economic Forum’s Global Risks Report sustainable investment. central to performance appraisal and we 3 ranks natural disasters and climate scenarios, and its positioning 2023 monitor for breaches and misconduct with in different investment strategies. a range of possible outcomes. Our investment in the sustainability function supports our culture principle of “being sustainable in everything that we do”. Bringing the Corporate Sustainability We aim to simplify Officer (CSO) function together with sustainable and impact investing cements the complexities AllianzGI’s commitment to operate as a sustainable business in a world in of sustainable which investors require a diverse range 2 investing by guiding of sustainable products and solutions. This will ensure that we operate as a good and partnering corporate citizen by positively contributing to communities and society, and delivering with clients and sustainable value for stakeholders. For more information, see section 04. other stakeholders. 2 For the avoidance of doubt, whenever using the term sustainable product/fund in this publication, AllianzGI refers to a product or fund classified as Article 8 or 9 under SFDR as a minimum criteria. 3 https://www3.weforum.org/docs/WEF_Global_Risks_Report_2023.pdf 14

This is a modal window.

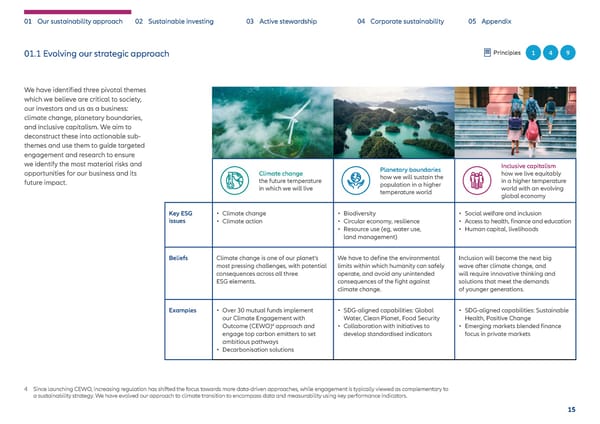

01 Our sustainability approach 02 Sustainable investing 03 Active stewardship 04 Corporate sustainability 05 Appendix 01.1 Evolving our strategic approach Principles 1 4 9 We have identified three pivotal themes which we believe are critical to society, our investors and us as a business: climate change, planetary boundaries, and inclusive capitalism. We aim to deconstruct these into actionable sub- themes and use them to guide targeted engagement and research to ensure we identify the most material risks and Planetary boundaries Inclusive capitalism opportunities for our business and its Climate change how we will sustain the how we live equitably future impact. the future temperature population in a higher in a higher temperature in which we will live temperature world world with an evolving global economy Key ESG • Climate change • Biodiversity • Social welfare and inclusion issues • Climate action • Circular economy, resilience • Access to health, finance and education • Resource use (eg, water use, • Human capital, livelihoods land management) Beliefs Climate change is one of our planet’s We have to define the environmental Inclusion will become the next big most pressing challenges, with potential limits within which humanity can safely wave after climate change, and consequences across all three operate, and avoid any unintended will require innovative thinking and ESG elements. consequences of the fight against solutions that meet the demands climate change. of younger generations. Examples • Over 30 mutual funds implement • SDG-aligned capabilities: Global • SDG-aligned capabilities: Sustainable our Climate Engagement with Water, Clean Planet, Food Security Health, Positive Change 4 Outcome (CEWO) approach and • Collaboration with initiatives to • Emerging markets blended finance engage top carbon emitters to set develop standardised indicators focus in private markets ambitious pathways • Decarbonisation solutions 4 Since launching CEWO, increasing regulation has shifted the focus towards more data-driven approaches, while engagement is typically viewed as complementary to a sustainability strategy. We have evolved our approach to climate transition to encompass data and measurability using key performance indicators. 15

01 Our sustainability approach 02 Sustainable investing 03 Active stewardship 04 Corporate sustainability 05 Appendix 01.1 Evolving our strategic approach Principles 1 4 9 The year 2021 saw significant evolution of our Risk and exclusion flags: greater clarity These enhancements also help to identify Our focus for 2022 included: approach to sustainable investing, setting the to improve understanding of the reasons what types of investors can hold specific scene for 2022. The year’s geopolitical events for exclusions. assets, which is important for technical • Addressing the close interconnectivity and regulatory environment, however, considerations and positioning. All of between the climate crisis and created unexpectedly testing market Clearer guidance: a new framework this informs how we can engage and biodiversity. We see these as key themes dynamics for sustainable investors. Our focus on regulatory measures (sustainable target stewardship outcomes for investee to be tackled in collaboration with remained a commitment to developing investment share, “Do No Significant holdings, which can add important other stakeholders. The need to tackle scalable solutions to support the transition Harm” principles, EU taxonomy shares) perspectives on how to interpret existing risks and opportunities associated with from ESG to sustainability to impact. which combines a quantitative approach data sets at a time when data continues biodiversity loss has been emphasised with qualitative research. to evolve. by food supply shortages because of The implementation of this strategy in 2022 the war in Ukraine and droughts around included a number of key developments Evolving climate data capture: data Looking ahead to 2023, having developed the world in 2022. which underpin our vision for credible monitoring to support decarbonisation a robust architecture for the “inputs” • The future of energy accelerated as sustainable investing and meaningful impact. pathways and net zero alignment. into investment decisions, we will turn a theme following the outbreak of war our attention to the best way to approach in Ukraine in February 2022. Energy is Sector research: enhanced sustainability Performance transparency: expanding the outcome or “impact” of those central to our themes of climate change sector frameworks, showing how an key performance indicators (KPIs) for investment decisions and the extent to and inclusive capitalism. industry sector screens on multiple planetary boundaries and inclusive which capital has achieved non-financial • Inclusive capitalism has come to the fore factors, and our proprietary Sustainability capitalism topics in line with work done goals alongside financial returns. as investors look to increasingly embed Materiality Matrix identifies the most on climate change KPIs. We expect to see accelerating progress social factors into decision making. material E, S and G sub-factors for in the coming year. This touches upon social inclusion, but is 24 broad sector classifications. We believe enhanced research and our new highly interconnected with climate proprietary Sustainability Insights Engine 01.1.2 Focusing on the material change, biodiversity loss and welfare Company research: we developed separate (SusIE) will enable colleagues across the sustainability themes of today security deriving from food, water and absolute company ESG scores to provide investment platform to help investors and tomorrow and energy. additional perspectives for investment understand the scope of non-financial Our approach is guided by the material See section 02.2.1 for insights decision-making. We supplemented these considerations of investee companies, sustainability themes of today and those from our research across themes with detailed company analysis commentary and the potential for this to influence of tomorrow, which requires a constant including sustainable food systems, which now includes human rights – a key financial returns. focus on the shifting global context. healthcare and energy security. topic within our inclusive capitalism theme. 16

01 Our sustainability approach 02 Sustainable investing 03 Active stewardship 04 Corporate sustainability 05 Appendix 01.1 Evolving our strategic approach Principles 1 4 6 01.1.3 How active asset In 2022 we built out our thematic • Advising on sustainability risks and • Active stewardship continues to be management supports the engagement approach along these engineering active investment solutions a core action across our product transition to a better future three themes. that meet our clients’ individual strategies: in 2022, we engaged with 355 We are fully committed to active asset See section 03.1. objectives, powered by an innovative companies across 11 different sectors management, which offers unique approach to allocation and a deep and 28 countries. We participated advantages in today’s investment Other highlights include: understanding of risk. With 60 advisers in 10,200 shareholder meetings in environment – whatever the asset class, globally, risklab – an advisory team 2022, representing 94% of all votable geographic scope or investment style. • Integrating ESG risk considerations into within AllianzGI – helps our clients to meetings. We voted against, withheld, Being active allows us to stay ahead of all our investment processes and active meet their investment goals through or abstained from at least one agenda our clients’ future needs and to manage stewardship approach. specialist advice and solutions. In 2022, item at 69% of all meetings globally, developing risks and opportunities for See section 02.5. our sustainability-specific capabilities and overall we opposed 22% of all sustainable investing. • Constructing portfolios designed within risklab helped more than resolutions globally. to deliver financial returns over the 25 clients understand and enhance the See section 03. As part of our active approach, long term combined with strong sustainability profiles of their portfolios. we have further embedded the three sustainability performance. See section 01.3. sustainability themes that we identified See section 02.6. • Financing the United Nations’ In 2022, the Sustainability Team in 2021. These continue to shape our Sustainable Development Goals (SDGs) developed a firm-wide sustainability research and engagement activities • Enhancing our ESG approach in private by incorporating ESG considerations training programme, launched in and underpin our entire approach markets alongside creating an Impact in our active investment decisions. Q1 2023 and mandatory for all to sustainable investing: Management and Measurement team. We partner with our clients to mobilise employees globally. This training This team has built the AllianzGI impact capital to meet multiple sustainability- has been designed to help • Climate change: finding solutions to avoid framework for private markets to related goals, such as those set out our employees enhance their the harmful effects of climate change. ensure investments generate material in the UN SDGs. Our SDG-aligned understanding of what sustainability • Planetary boundaries: how we sustain and measurable positive impact for strategies specifically address the means to AllianzGI and what it will ourselves in a higher temperature world. our clients. financing of the SDGs. take to deliver on our ambition to • Inclusive capitalism: living equitably See section 02.6. See section 02.6.3. become a sustainability shaper. in a world with a rising population and increasing resource constraints. 17

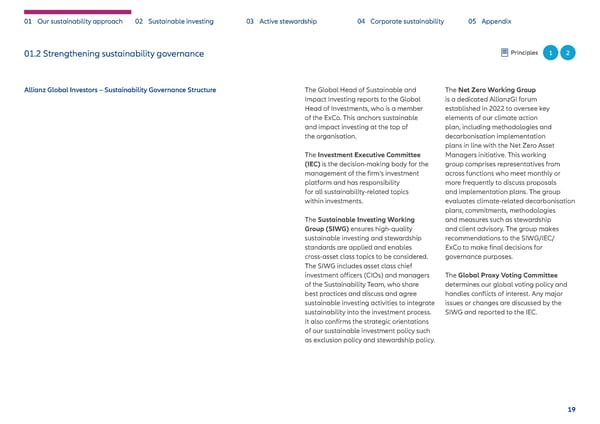

01 Our sustainability approach 02 Sustainable investing 03 Active stewardship 04 Corporate sustainability 05 Appendix 01.2 Strengthening sustainability governance Principles 1 2 Responsible and transparent In 2021, Allianz established a centralised governance is crucial to enable Global Sustainability function which the creation of sustainable value supports the Sustainability Board in for all our stakeholders. integrating sustainability into the business. Also in 2021, the Sustainability Committee was created within the Supervisory We are committed to clear and Board of Allianz SE to drive sustainability transparent governance principles strategy integration and implementation. and this commitment extends to our Sustainability-related performance is governance of sustainable investing integrated in compensation systems and stewardship. Sustainability is through relevant targets, incentivising embedded throughout AllianzGI and our board members to act and make decisions sustainability ambition is set by senior according to E, S and G priorities. management as part of the overall For more information, see the Allianz strategy of the business. As part of the Group Sustainability Report 2022. Allianz Group, we are subject to its governance requirements relating 01.2.1 Our sustainability to ESG matters. governance structure AllianzGI has clearly established lines Allianz has increased the importance of responsibility for sustainability, of sustainability with the ambition to which enables effective oversight fully integrate sustainability across the and accountability: company. The Board of Management at Allianz SE is ultimately responsible for The Executive Committee (ExCo) is the all matters related to sustainability and central governance and decision-making is supported by the Group Sustainability body for AllianzGI and other relevant Board (formerly known as the ESG Board). committees on sustainability issues. 18

01 Our sustainability approach 02 Sustainable investing 03 Active stewardship 04 Corporate sustainability 05 Appendix 01.2 Strengthening sustainability governance Principles 1 2 Allianz Global Investors – Sustainability Governance Structure The Global Head of Sustainable and The Net Zero Working Group Impact Investing reports to the Global is a dedicated AllianzGI forum Head of Investments, who is a member established in 2022 to oversee key of the ExCo. This anchors sustainable elements of our climate action and impact investing at the top of plan, including methodologies and the organisation. decarbonisation implementation plans in line with the Net Zero Asset The Investment Executive Committee Managers initiative. This working (IEC) is the decision-making body for the group comprises representatives from management of the firm’s investment across functions who meet monthly or platform and has responsibility more frequently to discuss proposals for all sustainability-related topics and implementation plans. The group within investments. evaluates climate-related decarbonisation plans, commitments, methodologies The Sustainable Investing Working and measures such as stewardship Group (SIWG) ensures high-quality and client advisory. The group makes sustainable investing and stewardship recommendations to the SIWG/IEC/ standards are applied and enables ExCo to make final decisions for cross-asset class topics to be considered. governance purposes. The SIWG includes asset class chief investment officers (CIOs) and managers The Global Proxy Voting Committee of the Sustainability Team, who share determines our global voting policy and best practices and discuss and agree handles conflicts of interest. Any major sustainable investing activities to integrate issues or changes are discussed by the sustainability into the investment process. SIWG and reported to the IEC. It also confirms the strategic orientations of our sustainable investment policy such as exclusion policy and stewardship policy. 19

01 Our sustainability approach 02 Sustainable investing 03 Active stewardship 04 Corporate sustainability 05 Appendix 01.2 Strengthening sustainability governance Principles 1 2 Established in May 2022, the Corporate AllianzGI consists of several operational Sustainability Working Group comprises entities and additional lines of two ExCo members for Investments and responsibility exist at the AllianzGI GmbH Shaping sustainable pathways towards change Finance, the Corporate Sustainability level. The GmbH Management Board Officer, and four department heads in is responsible for overall strategy and the areas of Technology, Operations and corporate sustainability and sustainable Strengthening sustainability Products; Human Resources; Marketing investing strategy. It reports to the and Communications; and Sustainable supervisory board. The GmbH supervisory governance in Asia Pacific in 2022 and Impact Investing. The working group board receives regular updates on the meets monthly and ensures effective business strategy of AllianzGI GmbH from execution of the corporate sustainability the management board. This includes a We have strengthened sustainability governance structures strategy and the integration of associated section on the latest strategic updates in Hong Kong, Singapore and Taiwan to combine global initiatives and principles. regarding sustainability. oversight with local oversight of sustainability. The Reputational Risk Working Group The AllianzGI Asia Pacific Legal relating to climate risk and sustainable comprises global representatives Compliance Risk Working Group investing are discussed at semi-annual from across functions who meet twice monitors the ESG risk profile and board meetings. yearly to discuss topics that may pose a climate scenario stress-test findings reputational risk and determine whether related to AllianzGI’s Asia Pacific In Taiwan, a cross-functional action is necessary, including escalation investments on a quarterly basis. sustainability working group works to senior management. The group may closely with the global Sustainable input on ad-hoc topics that require a Both the Hong Kong and Singapore Investing team to monitor trends collaborative sounding board to assess boards also receive quarterly reports and regulations in the sustainable the need for action. on the ESG risk profile and climate investing space, report on material Other working groups are dedicated to scenario stress test results of locally ESG developments to the Taiwan sustainable investment across different asset managed and domiciled funds. board, and coordinate provision of classes and investment methodologies. These reports and other material topics ESG-related training. 20

This is a modal window.

01 Our sustainability approach 02 Sustainable investing 03 Active stewardship 04 Corporate sustainability 05 Appendix 01.2 Strengthening sustainability governance Principles 1 2 Linking sustainability with remuneration clear lines of responsibility. Sub-teams Sustainability Research and is gender-balanced as part of our The International Management Group cooperate closely and report directly Stewardship teams: manage thematic commitment to diversity, which enables –comprising senior functional heads to Matt Christensen, Global Head of research and engagement strategy and us to create a holistic and interdisciplinary from across the firm – has sustainability Sustainable and Impact Investing. develop a thematic approach along view on all aspects of sustainable embedded in its goals through firm- the strategic topics of climate change, investment. We continuously assess the wide global solidarity goals. A specific Sustainable Investment Office (SIO) planetary boundaries and inclusive training needs of the team and several sustainability goal was introduced in team: shapes AllianzGI’s overall capitalism. The Stewardship team leads team members have participated in the 2021 and implemented in 2022. This goal sustainable investment strategy and AllianzGI’s engagement and proxy-voting CFA UK Level 4 Certificates for Climate targets sustainability achievement as policies and its sustainable product activities globally. and Investing and Investing in ESG, measured by delivery of above-median strategy, as well as leading key helping to develop this course which was signatories’ Principles for Responsible initiatives. The team plays a critical role in Strengthening our focus on in its pilot phase at the time. The outcome Investment (PRI) results. Achievement of providing knowledge to clients and other corporate sustainability of this was to widen the spread of climate the global solidarity goals5 influences stakeholders on AllianzGI’s sustainable In May 2022, we established the role of knowledge, which in turn means we can the firm-wide remuneration pool. investment capabilities. Corporate Sustainability Officer (CSO) to be more effective in deploying relevant AllianzGI functions are also embedding ensure AllianzGI’s organisational business expertise across our activities such sustainability considerations into team Sustainability Methodologies and practices are environmentally and socially as engagement. and individual goals. For instance, Analytics (SMA) team: responsible for sustainable. The CSO communicates the investment platform has implemented driving innovation using state-of-the-art and coordinates with management, Growing our impact investing expertise goals that specifically reflect the way technology and ESG data. This includes clients, employees and community Impact investing is an important and fast- sustainability is integrated into the fund employing artificial intelligence (AI), partners to address sustainability issues. growing asset class that facilitates positive and focus areas of each team. natural language processing (NLP) The role develops, manages and monitors change while resonating with growing and new forms of data to support the corporate sustainability strategy. interest from clients. Opportunities are 01.2.2 Investing in our team the Sustainability Research team, increasing fast, particularly in private With sustainability and impact being developing new methodologies across Widening our climate knowledge markets. Where investors previously a strategic growth area, AllianzGI has asset classes, delivering innovative tools The members of the Sustainable and thought only in terms of risk and reward, established a growing team dedicated for our investment platforms and shaping Impact Team have a diverse range of they can now add impact as a third to sustainable investment and shaping client-oriented solutions. The team professional backgrounds including dimension of oversight for their portfolios. sustainable pathways. It now includes oversees ESG integration and scoring finance, investment, legal, environmental close to 40 team members structured with approaches and develops the climate and sustainability expertise. The team strategy dataset. 5 Solidarity goals are corporate goals specific to Allianz Global investors which include, for example financial targets, client service metrics, employee engagement targets. 21

01 Our sustainability approach 02 Sustainable investing 03 Active stewardship 04 Corporate sustainability 05 Appendix 01.2 Strengthening sustainability governance Principles 1 2 5 To leverage the growth opportunity, and procedures at least annually to and developments in the jurisdictions in management services due to changes we must ensure that our investments ensure continuous improvement. In 2022, which we operate. To be at the forefront stemming from the Markets in Financial create credible impact and measure this included strengthening our corporate of sustainability regulation, we set Instruments Directive (MiFID) II. and report on this impact. governance guidelines and proxy up a global regulation workstream voting policy. to implement sustainability-related AllianzGI’s Executive Committee reviewed Our Impact Investing team is responsible See section 03.7.2. regulation into our business including and approved this Sustainability and for managing private equity social into the investment approach. Stewardship Report 2022. In doing and environmental impact portfolios We also reviewed our processes to so, they consider the report to provide and prioritising commercial capital to meet the requirements of sustainability In 2022, we were implementing new a fair and balanced view of our achieve the UN Sustainable Development labels for our funds when it comes regulation in Hong Kong, Singapore approach to sustainable investing and Goals. The Impact Measurement and to engagement. and Taiwan as well as in the EU. stewardship activities as well as corporate Management team developed and Rules are focusing on governance and sustainability initiatives. Initial input launched AllianzGI’s impact framework Review processes are led by our risk management as well as detailed was provided by the respective teams in 2021. The framework – designed to Sustainable Investment Office and and stringent disclosure. The EU has also responsible for the various activities, ensure high standards of impact due Stewardship team. All review processes introduced sustainability preferences with overall review by the Sustainability diligence, measurement and management are based on regulatory requirements in investment advice and portfolio and Impact Team. –has since been fully integrated into the Allianz Impact Investment Fund’s Organisational structure – Sustainability and Impact Team (AIIF) investment process, with AIIF also publishing its inaugural Annual Impact Report in 2022. The framework is in the process of being integrated into a number of upcoming impact investing strategies. See section 02.6. 01.2.3 Robust review and assurance The credibility of our approach, as reflected in our internal processes and external reporting, is crucial to ensure trust in our company. We have sound processes in place to review ESG-related policies 22

01 Our sustainability approach 02 Sustainable investing 03 Active stewardship 04 Corporate sustainability 05 Appendix 01.3 Guiding clients on sustainable investment solutions Principle 6 As an active asset manager, we create solutions and products We also share our investment expertise and voting. The climate strategies that address clients’ evolving investment objectives. We manage via client meetings and host regular of companies are a particular focus EUR 506 billion6 across all asset classes in public and private client events on sustainable investing. of these meetings. We also provided markets for our global client base and aim to give investors access These provide a platform for renowned clients with insights on our voting policy keynote speakers and AllianzGI’s own review, voting processes and decisions. to a broad range of sustainable investment strategies. sustainable investment experts to discuss In these conversations we collected the opportunities and challenges of feedback on where our processes could Since the inception of our first sustainable our ESG credentials, internal research sustainable investing, emerging regulatory be improved and transparency enhanced. investment strategy in 1999, the number capabilities, the robustness of our frameworks across jurisdictions, and the Feedback was used to inform our proxy of sustainable products we offer reached methodologies and the extent to measurability of sustainable and impact voting policy review. 177 at the end of 2022, up from 150 which ESG criteria are considered and investment strategies. In 2022, we hosted at the end of 2021. In 2022, we converted incorporated in investment processes. the Global Sustainability Days – a two-day 01.3.2 Maintaining our position as a 31 mutual funds to a sustainable online event during which experts and client service leader investing approach and launched five 01.3.1 Engaging with clients guest speakers from across the industry Our focus on providing guidance on new sustainable funds – a path we aim Engaging with clients is an opportunity debated the most pressing sustainability sustainable investment solutions is part of to continue in the future.7 to help them understand their sustainable issues. Together with our clients, a wider commitment to clients as we look investing preferences and objectives. we explored topics ranging from the beyond pure economic gain to develop Interest in sustainable investment This has been especially important in the future of sustainable finance regulation strong and enduring relationships. strategies continues to increase among context of the war in Ukraine. With energy to the twin crises of biodiversity loss and both retail and professional investors. prices rising sharply, fossil fuel-based climate change, and how to advance Our aim is to create value together and Both client segments are demanding energy production expanding in several inclusive capitalism. we want every interaction to support a higher level of sustainability-driven countries and weapon-producing this goal. We elevate clients’ investing considerations within the investment companies being among the strongest During regular client meetings, experience by understanding their process and they want to better outperformers in 2022, we provided we discuss stewardship activities and individual needs, providing the right understand sustainability features. perspectives and guidance through our gain important insights into engagement solutions and always acting in their Almost every request for proposal (RFP) thought leadership communications, themes clients would like us to prioritise. best interests. Drawing on our toolkit of or fund selection due diligence process including “Sustainable Minute” videos For certain portfolios, we hold dedicated capabilities, we create solutions that help we are part of now contains multiple on social media and dedicated client ESG feedback meetings to discuss the clients achieve their investment objectives ESG-related questions aiming to assess update calls. decarbonisation pathway of the portfolio today and in the future. and the outcomes of engagement 6 Data as at 31 December 2022. 7 These figures relate to EU-domiciled funds that are classified as either Article 8 or Article 9 under SFDR. 23

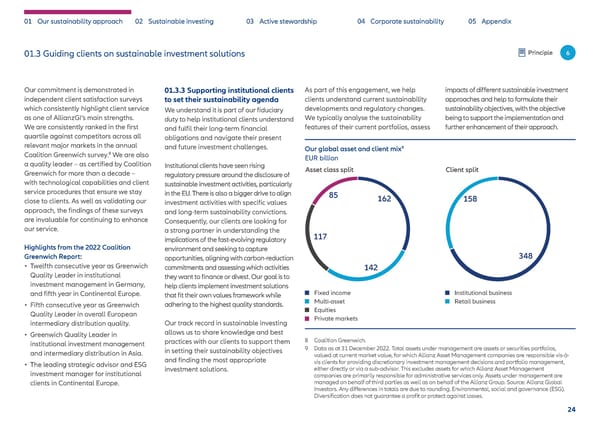

01 Our sustainability approach 02 Sustainable investing 03 Active stewardship 04 Corporate sustainability 05 Appendix 01.3 Guiding clients on sustainable investment solutions Principle 6 Our commitment is demonstrated in 01.3.3 Supporting institutional clients As part of this engagement, we help impacts of different sustainable investment independent client satisfaction surveys to set their sustainability agenda clients understand current sustainability approaches and help to formulate their which consistently highlight client service We understand it is part of our fiduciary developments and regulatory changes. sustainability objectives, with the objective as one of AllianzGI’s main strengths. duty to help institutional clients understand We typically analyse the sustainability being to support the implementation and We are consistently ranked in the first and fulfil their long-term financial features of their current portfolios, assess further enhancement of their approach. quartile against competitors across all obligations and navigate their present relevant major markets in the annual and future investment challenges. 9 Coalition Greenwich survey.8 We are also Our global asset and client mix a quality leader – as certified by Coalition EUR billion Institutional clients have seen rising Asset class split Client split Greenwich for more than a decade – regulatory pressure around the disclosure of with technological capabilities and client sustainable investment activities, particularly service procedures that ensure we stay in the EU. There is also a bigger drive to align 85 162 158 close to clients. As well as validating our investment activities with specific values approach, the findings of these surveys and long-term sustainability convictions. are invaluable for continuing to enhance Consequently, our clients are looking for our service. a strong partner in understanding the implications of the fast-evolving regulatory 117 Highlights from the 2022 Coalition environment and seeking to capture Greenwich Report: opportunities, aligning with carbon-reduction 348 • Twelfth consecutive year as Greenwich commitments and assessing which activities 142 Quality Leader in institutional they want to finance or divest. Our goal is to investment management in Germany, help clients implement investment solutions and fifth year in Continental Europe. that fit their own values framework while Fixed income Institutional business • Fifth consecutive year as Greenwich adhering to the highest quality standards. Multi-asset Retail business Quality Leader in overall European Equities intermediary distribution quality. Our track record in sustainable investing Private markets • Greenwich Quality Leader in allows us to share knowledge and best institutional investment management practices with our clients to support them 8 Coalition Greenwich. and intermediary distribution in Asia. in setting their sustainability objectives 9 Data as at 31 December 2022. Total assets under management are assets or securities portfolios, and finding the most appropriate valued at current market value, for which Allianz Asset Management companies are responsible vis-à- • The leading strategic advisor and ESG vis clients for providing discretionary investment management decisions and portfolio management, investment manager for institutional investment solutions. either directly or via a sub-advisor. This excludes assets for which Allianz Asset Management companies are primarily responsible for administrative services only. Assets under management are clients in Continental Europe. managed on behalf of third parties as well as on behalf of the Allianz Group. Source: Allianz Global Investors. Any differences in totals are due to rounding. Environmental, social and governance (ESG). Diversification does not guarantee a profit or protect against losses. 24

01 Our sustainability approach 02 Sustainable investing 03 Active stewardship 04 Corporate sustainability 05 Appendix 01.3 Guiding clients on sustainable investment solutions Principle 6 Shaping sustainable pathways towards change Providing sustainable investment advice with risklab risklab is AllianzGI’s Sustainable investment challenges faced by our clients and answers offered by risklab advisory and solutions Sustainability transparency Actionable advice Customised solutions unit helping investors with asset allocation, risk management, private What is the carbon footprint of my How do different climate scenarios How can I increase my allocation markets implementation current portfolio? impact the achievement of my risk to green bonds, while not In which parts of my portfolio and return goals? significantly shifting my portfolio’s and achieving sustainable do I face security-based Which benchmarks can I use to financial characteristics? investment goals. reputational risks? decarbonise my portfolio or lower How can the positive impact my climate transition risk? generated by the projects In 2022, risklab continued to expand Progress in 2022 underlying the green bonds be its sustainable investing expertise • Best practice analysis via peer group Progress in 2022 reflected in my reporting? by allocating further resources to its studies of different investor groups • Climate scenarios (according to Sustainable Investment Advisory team. (eg, pensions, insurers) and their NGFS11 and incorporating physical Progress in 2022 The three pillars of its advisory offering sustainable investment behaviour. and transition risk) integrated into our • Partnering with clients and portfolio aim to support clients to navigate • Proprietary analytics tool upgraded capital markets model to help clients managers to jointly develop customised complex sustainability journeys to a cloud-based application assess the risk of return shortfalls due solutions that fit the client’s needs and shape the future of sustainable (SARAH 2.010) together with additional to climate risk and align their strategic and implement shifts in strategy investing together, as demonstrated by advisory modules (eg, net zero advice) asset allocation accordingly. (eg, increase in green bonds/decrease these representative client questions and incorporating supplementary in carbon intensity in a corporate and key areas of our responses. sustainability and financial data from bond portfolio). internal and external sources. 10 Sustainability Analytics, Research & Advisory Hub. 11 The Central Banks and Supervisors Network for Greening the Financial System (NGFS), a group of central banks and supervisors willing, on a voluntary basis, to exchange experiences, share best practices, contribute to the development of environment and climate risk management in the financial sector, and to mobilise mainstream finance to support the transition toward a sustainable economy. 25

01 Our sustainability approach 02 Sustainable investing 03 Active stewardship 04 Corporate sustainability 05 Appendix 01.3 Guiding clients on sustainable investment solutions Principle 6 We assess the ambition levels of clients through questionnaires and by discussing Shaping sustainable pathways towards change best market practice. This enables us to determine their preferences and motivation, while considering existing The widening Supporting a client to define policies and potential memberships and commitments to organisations and spread of specialist actions based on investor principles of sustainable investing. As a core feature of our advice, we help clients technical knowledge goals and preferences gauge their portfolio sustainability profile and quality in combination with financial enables us to draw In a joint effort with a German family office, we conducted a risk-and-return characteristics. on team resource sustainability preference assessment with their key stakeholders To leverage the sustainability expertise more efficiently. to inform the client’s sustainable investment direction. within AllianzGI, risklab collaborates with our investment platform regarding We will continue to expand our offering We also carried out a status quo and investment managers and used investment solutions, investment trends, by developing additional quantitative and analysis for parts of the client portfolio the outcomes of these to define a best practice and implementation. qualitative advisory modules, angles of via our Sustainability Analytics, potential framework, which included Analytical capabilities are aligned with and analysis in the simulation of sustainable Research & Advisory Hub (SARAH). an exclusion policy, participation enhanced through close collaboration with investment approaches and a potential The process started with a workshop in initiatives and decarbonisation AllianzGI’s Sustainability Methodologies extension of asset classes in portfolio on sustainable investing, best practices goals based on the preferences and and Analytics team, which identifies, analytics and capital market modelling. of global and European family goals of the investors. Following this, manages and masters sustainability data offices, ESG regulation and in-depth we delivered an analysis of the client and develops proprietary analytical tools analysis of sustainable investing portfolio across different sustainability and methodologies. approaches and the respective metrics such as ESG rating, exposure benchmarks. We conducted polls to controversies, and carbon emissions and questionnaires with stakeholders and intensity. 26

01 Our sustainability approach 02 Sustainable investing 03 Active stewardship 04 Corporate sustainability 05 Appendix 01.3 Guiding clients on sustainable investment solutions Principle 6 Shaping sustainable pathways towards change Accompanying our largest client on its Shaping sustainable pathways towards change path to net zero Managing over EUR 200 Collaborating with a large billion for our shareholder, Allianz, we are a key partner public pension fund to in helping it to reach its implement climate policy ambitions across public and private markets as a founding We engaged with a leading engagement and exclusions. For the member of the Net-Zero Asset French public pension fund to portfolios we manage on behalf of Owner Alliance. support the implementation the asset owner, dialogue concerning We are working with Allianz to reach of its ambitious climate policy. measurement of decarbonisation an interim greenhouse gas (GHG) objectives, limits of carbon metrics emissions reduction target of 25% and phasing-in of Scope 3 data is by the end of 2024 across the listed The asset owner committed to ongoing. Our collaboration is enabling equity and corporate bond investments assign reserves to a decarbonisation the institution to focus on real-world that AllianzGI manages on behalf pathway towards a 1.5°C scenario climate impacts using forward- of Allianz, and by the end of 2025 and set stringent standards related to looking climate data to complement for infrastructure equity investments. portfolio decarbonisation, shareholder backward-looking carbon metrics. 27

This is a modal window.

01 Our sustainability approach 02 Sustainable investing 03 Active stewardship 04 Corporate sustainability 05 Appendix 01.3 Guiding clients on sustainable investment solutions Principle 6 Shaping sustainable pathways towards change Creating real-world impact in private markets Through our private markets impact investing strategies, we are committed to delivering positive environmental and social outcomes, which include supporting climate solutions that foster the transition towards a low-carbon economy in developing and developed markets. We launched our latest investment vehicle finance institution (DFI), which will invest –the Emerging Market Climate Action alongside other DFIs in Paris Agreement- Fund (EMCAF) – in late 2021 jointly with aligned projects. AllianzGI’s developed the European Investment Bank (EIB). markets-focused impact strategy – the EMCAF is an innovative blended equity Allianz Impact Investment Fund (AIIF) fund that finances climate mitigation –actively pursues direct and indirect and adaptation as well as environmental investments that generate positive projects in Africa, Asia, Latin America, measurable environmental and social and the Middle East. We will also be impact. We will additionally be building launching a blended climate solutions out our impact offering via a dedicated debt strategy (Allianz Climate Solutions strategy providing tailor-made credit Emerging Markets), in partnership with solutions to impactful companies in Allianz Group and a regional development developed markets. 28

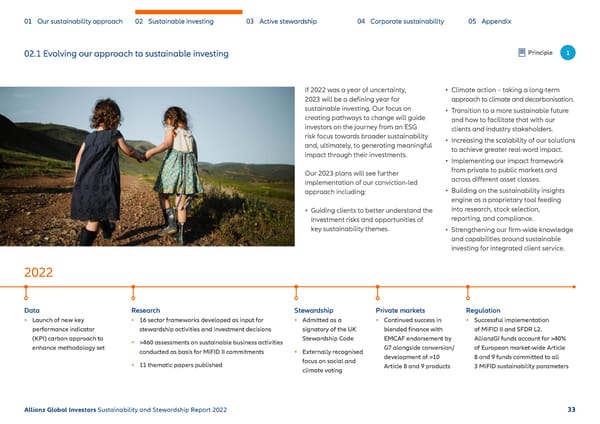

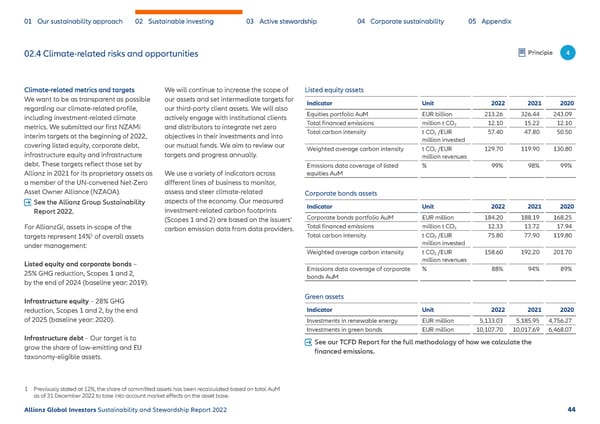

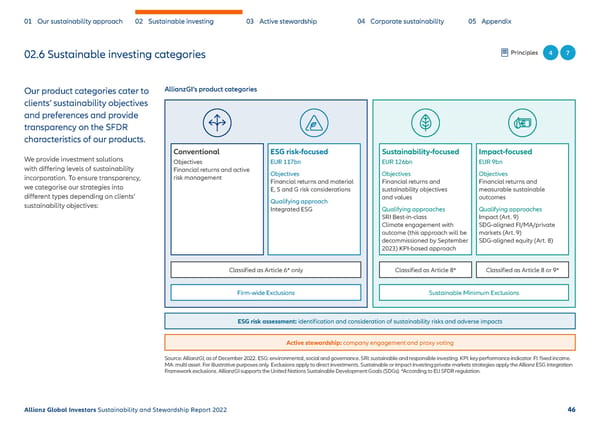

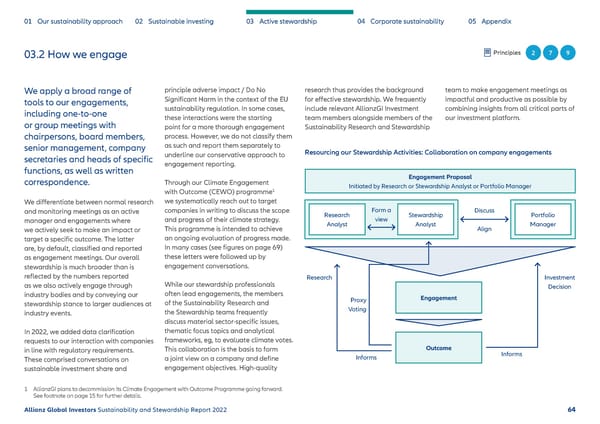

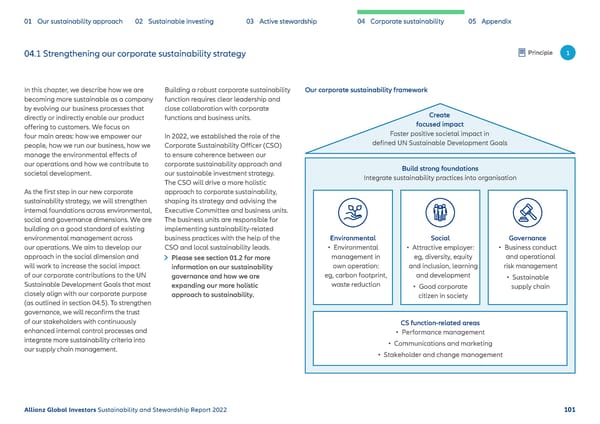

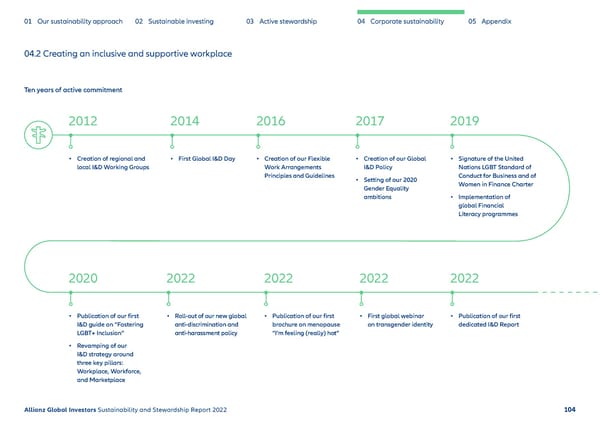

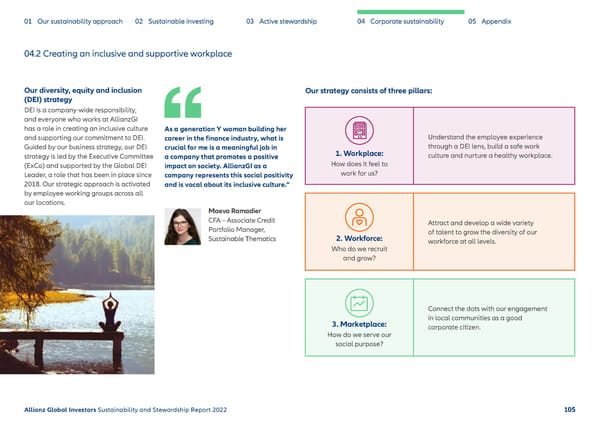

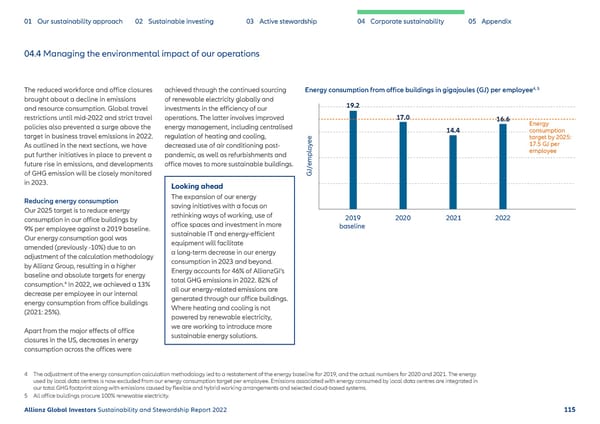

01 Our sustainability approach 02 Sustainable investing 03 Active stewardship 04 Corporate sustainability 05 Appendix 01.3 Guiding clients on sustainable investment solutions Principle 6 01.3.4 Increasing transparency of For example, in our conversations with Regulators in Europe and Asia Pacific are by participating in major regulatory sustainable investments some large clients, we observed that introducing various sustainable finance consultations. For example, AllianzGI was With the growth in sustainable investing, they would like to receive more granular regulations to ensure policy objectives of a member of the former EU Technical demand is increasing among investors reporting of engagement conversations greener and more inclusive financial flows Expert Group, and has been a member of and regulators for greater transparency with companies held in portfolios. are delivered and to increase transparency the EU Platform for Sustainable Finance over the performance and impact of for investors. For example, the EU Action during its first term ending in 2022, investments. We support this shift and Navigating the shifting Plan on Financing Sustainable Growth continuing into its second term in 2023. have provided monthly reporting on regulatory landscape includes common classification of sustainable investments to our clients The redirection of capital flows to finance environmentally sustainable activities We have initiated an ESG Programme since 2020. Clients can view their sustainable growth is becoming an within the EU sustainable finance to implement the required processes sustainable investments compared to the ever-greater priority for policy makers as taxonomy, and enhanced disclosure and enhance our product offering product benchmark and see the carbon financial market participants represent requirements for financial markets with to ensure we are prepared to meet footprint of their portfolios in absolute an important catalyst for channelling the Sustainable Finance Disclosure regulatory obligations and client demand and relative terms, as well as an overview private investments to create a more Regulation (SFDR) and the Corporate for sustainability. of the engagement activities relevant to sustainable economy. Sustainability Reporting Directive (CSRD). the fund. Major activities in 2022 included: It also required that sustainability is We are constantly enhancing our integrated into the investment process and • Integration of sustainability risk reporting to meet evolving regulatory investment advice through amendments and principal adverse impact (PAI) requirements and client needs. Our goal of the funds, asset management and assessments into the investment process, is to make sustainable information We aim to help insurance regulations. In Asia Pacific, as of 1 August 2022. digitally accessible via a dedicated client initiatives are underway in various markets • A review of our product offering reporting portal for institutional clients shape the regulatory to increase sustainability disclosure to address investors’ sustainability and distributors. The application we requirements and integrate sustainability preferences according to MiFID II. are developing will allow continuous landscape by risk into the investment process. • Detailed disclosure to create enhancements as reporting requirements transparency on Article 8 and 9 products and client needs evolve. Our clients’ participating in AllianzGI is taking an active role in the and meet the SFDR Level 2 requirement, stewardship and investment principles major regulatory development and implementation of as of 1 January 2023. shape how we manage their portfolios, sustainable finance regulation in order and we evolve our processes and consultations. to ensure a sensible outcome. We aim reporting in line with their needs. to help shape the regulatory landscape 29